Clayton, Dubilier & Rice LLC and PricewaterhouseCoopers Inc. turned to regular counsel on a deal announced Tuesday, Oct. 19, in which the New York private equity sponsor agreed to buy the professional service provider’s global mobility tax and immigration services business.

The deal is reported $2.2 billion, though the companies did not disclose terms.

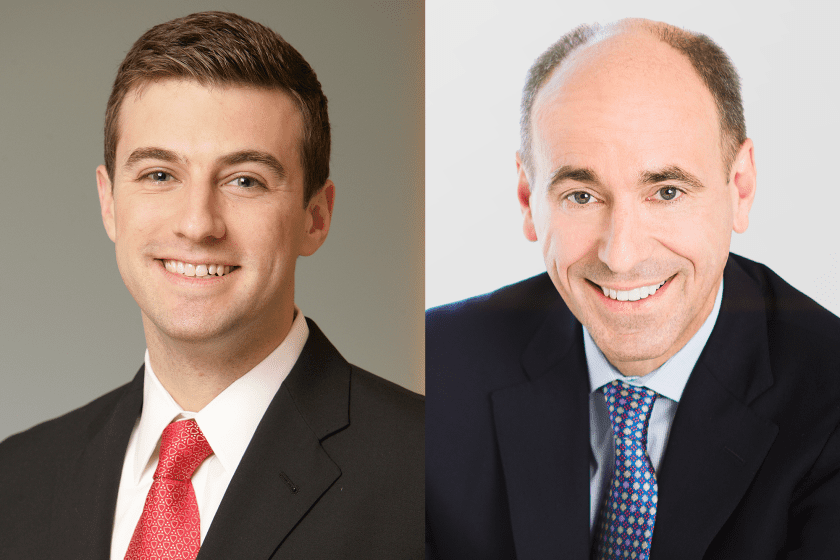

PwC, one of the Big Four accounting firms, tapped Harold Birnbaum and Oliver Smith of Davis Polk & Wardwell LLP along with George Yiend and Sarah Wiggins of Linklaters LLP in London for counsel and David Khayat, Greg Tarca and Seth Bergstein at Morgan Stanley & Co. LLC for financial advice. Birnbaum and Smith represented PwC on a 2017 deal with General Electric Co. (GE) in which PwC hired more than 600 of GE’s tax team members, acquired GE’s tax technologies and agreed to provide tax services to GE globally as well as on PwC’s 2014 acquisition of Booz & Co. Inc. Birnbaum also counseled PwC last year on its purchase of EagleDream Technologies, while Smith advised PwC on the 2018 sale of its U.S. public sector government consulting practice to Veritas Capital Fund Management LLC. Richard Godden and Sarah Wiggins at Linklaters also worked with PwC on the Booz deal.

CD&R used Paul Bird and Jennifer Chu of longtime outside counsel Debevoise & Plimpton LLP for M&A advice with Scott Selinger on finance and Steven Slutzky on capital markets. The banks financing the deal include Deutsche Bank Securities Inc., JPMorgan Chase & Co., UBS Investment Bank, BMO Capital Markets Corp., BNP Paribas Securities Corp., Mizuho Financial Group Inc., RBC Capital Markets LLC and Societe Generale SA.

The units CD&R is buying provide employee tax, immigration, business travel, mobility managed services and payroll management to companies. CD&R partner Stephen Shapiro is on the investment, while Peter Clarke, PwC’s global managing partner for global employee mobility, will be the CEO of the venture, which will be rebranded after the deal’s anticipated closing in the first half of 2022. CD&R partner Russell Fradin will chair the board of the new venture.

Editor’s note: The original version of this article was published earlier on The Deal’s premium subscription website. For access, log in to TheDeal.com or request a free trial.

This Content is Only for The Deal Subscribers

If you’re already a subscriber, log in to view this article here.