Chevron Corp. (CVX) has once again has turned to Scott Barshay at Paul, Weiss, Rifkind, Wharton & Garrison LLP for legal counsel on an acquisition.

San Ramon, Calif.-based Chevron agreed to buy Renewable Energy Group Inc. (REGI) for $3.15 billion in cash in a deal announced Feb. 28. The energy giant turned to Kyle Seifried and Barshay at Paul Weiss for counsel and Suhail Sikhtian and Scott Grandt at Goldman, Sachs & Co. for financial advice. Managing counsel for major transactions Siva Barnwell Adams and chief governance officer Mary A. Francis worked on the deal at Chevron.

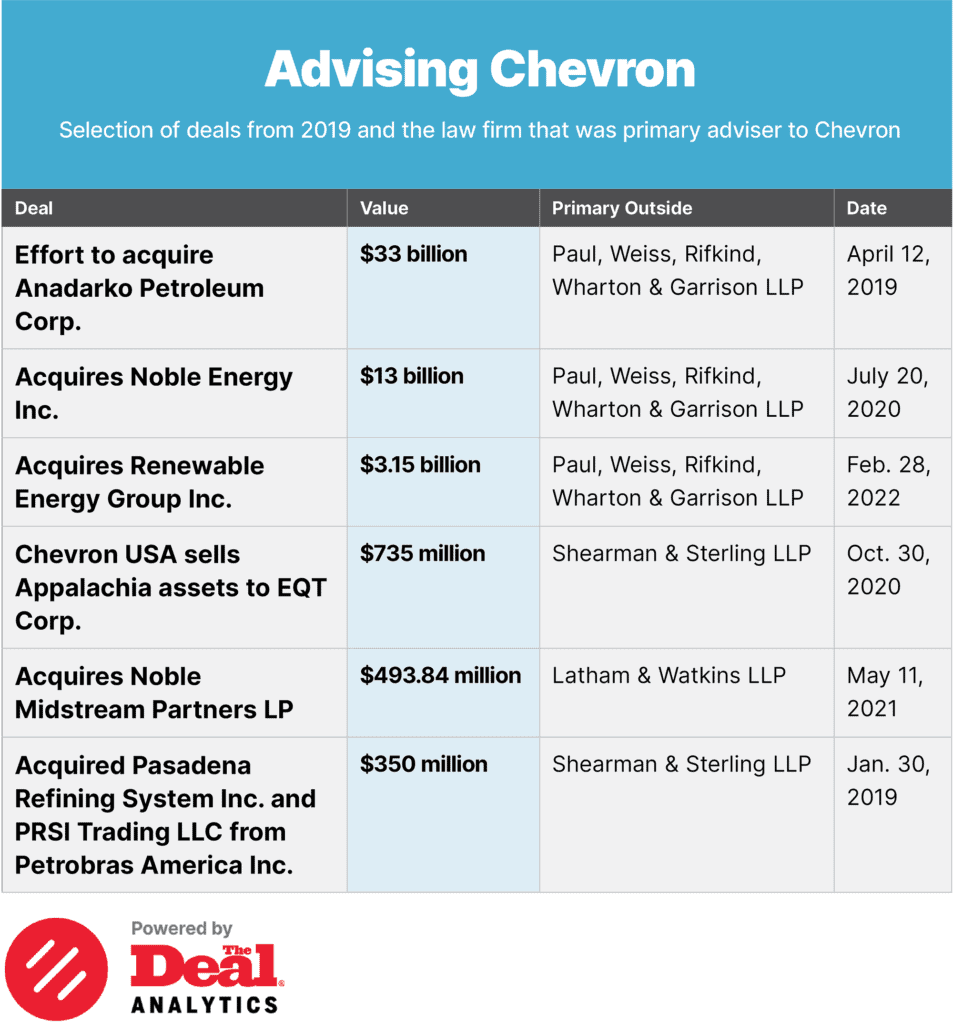

Barshay advised Chevron on a $13 billion purchase of Noble Energy Inc. in 2020 and a failed 2019 effort to buy Anadarko Petroleum Corp. Chevron struck a $33 billion agreement to buy Anadarko, which ended up taking a higher offer from Occidental Petroleum Corp. (OXY). Barshay also counseled Chevron on its $19 billion purchase of Unocal Corp. in 2005.

Renewable, an Ames, Iowa-based producer of biodiesel, tapped Bradley Faris, Mark Gerstein and David Owen of Latham & Watkins LLP for counsel and Alan Schwartz, James Schaefer, Dan Moore, Eric Rutkoske and Allen Otto of Guggenheim Securities LLC for financial advice. Justin Hovey of longtime company counsel Pillsbury Winthrop Shaw Pittman LLP also worked on the deal. Renewable’s general counsel is Eric Bowen.

Faris and Gerstein also advised auto parts maker Tenneco Inc. (TEN) on an agreement to sell to Apollo Global Management Inc. (APO) for $7.1 billion in cash announced Feb. 23. The duo worked with Renewable director Walter Berger when he was the CFO at Leap Wireless International Inc., and he introduced them to the company. Pillsbury took Renewable public in 2012.

Chevron will pay $61.50 per share in cash for Renewable, a premium of 40% to the target’s closing price on Feb. 25 the last trading day before the deal was announced, and of 57% to Renewable’s average in the previous 30 days. The companies hope to close the deal in the second half of the year.

Request a demo of The Deal Analytics.

Editor’s note: The original version of this article was published earlier on The Deal’s premium subscription website. For access, log in to TheDeal.com or use the form below to request a free trial.