In the past five years, Coty Inc. (COTY) has spent time reshaping its portfolio and shoring up liquidity with a recent interest in brands developed by the Kardashian-Jenner celebrity family. Along the way, Cooley LLP and Skadden, Arps, Slate, Meagher & Flom LLP have been there for each step on either side of the star-studded negotiating table.

On Monday, June 29, when Kim Kardashian West Beauty, the three-year-old company founded by Kim Kardashian, agreed to sell a 20% stake to Coty for $200 million, the two firms were involved.

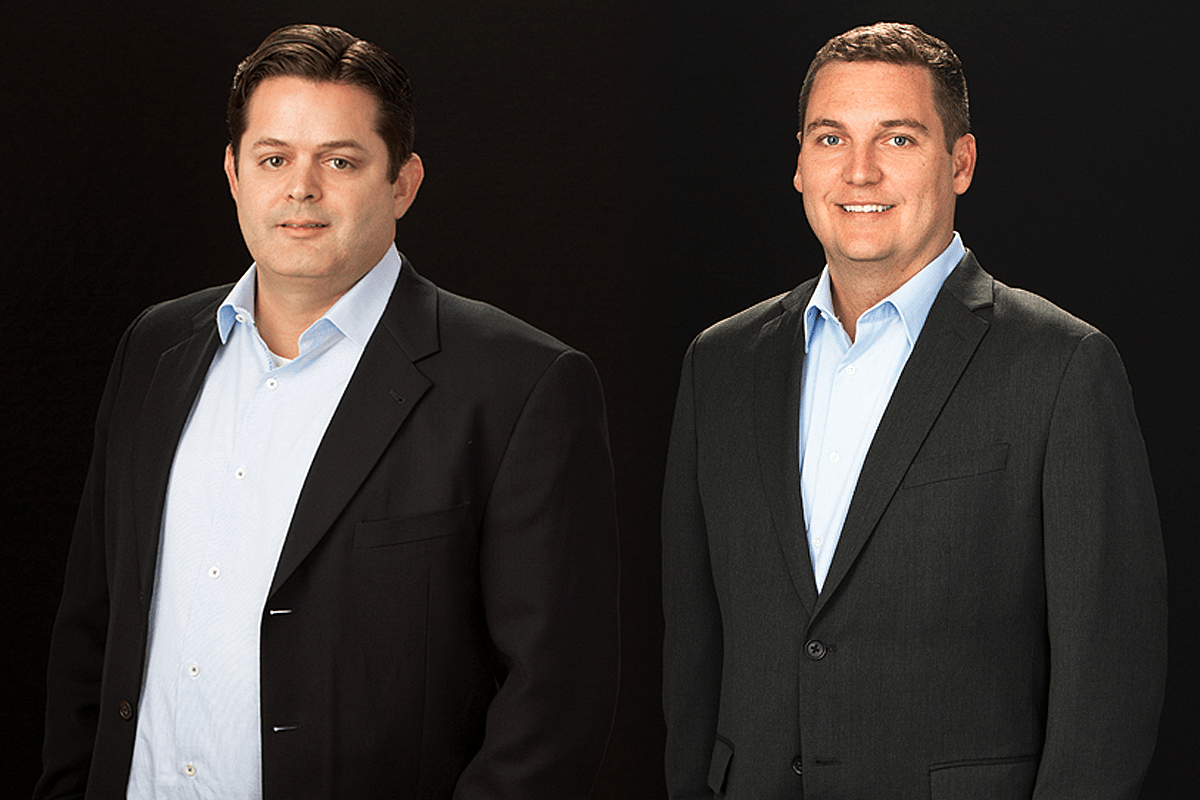

Cooley’s David Young and Matt Hallinan advised Kim Kardashian West Beauty on the Coty deal. The pair advised Kim’s half-sister Kylie Jenner on a deal announced in November and closed in January where Coty paid $600 million for a majority stake in Jenner’s King Kylie LLC brand.

Coty tapped Sean Doyle, Alexandra McCormack and Paul Schnell of Skadden for counsel on both the King Kylie and KKW deals. The law firm advised Coty on a deal announced in May in which KKR & Co. (KKR) agreed to buy $750 million of convertible preferred shares in Coty and signed a memorandum of understanding to buy a majority stake in Coty’s Professional Beauty and Retail Hair Businesses including the Wella, Clairol, OPI and ghd brands at an enterprise value of $4.3 billion.

Editor’s note: The original version of this article, including more adviser detail and relationships, was published earlier on The Deal’s premium subscription website. For access, log in to TheDeal.com or use the form below to request a free trial.

This Content is Only for The Deal Subscribers

If you’re already a subscriber, log in to view this article here.