Clayton, Dubilier & Rice LLC and TPG Capital LP looked to familiar faces on a May 25 agreement to buy Portland, Maine-based animal health and products Covetrus Inc. (CVET) for $4 billion.

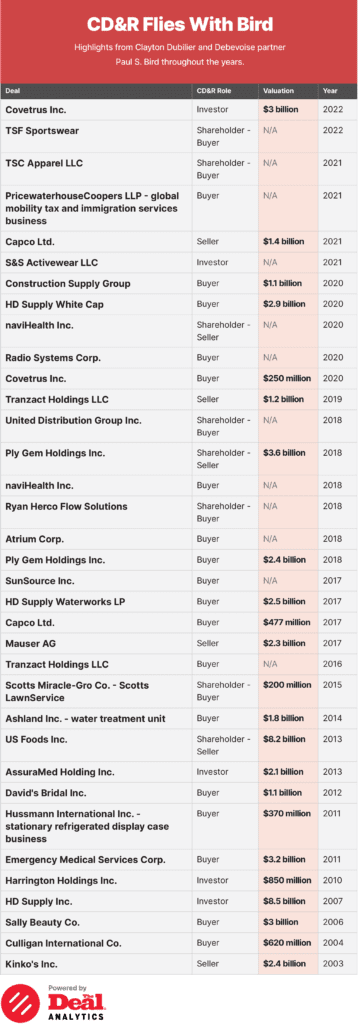

The New York private equity sponsor, which already owned a 24% stake in the target, tapped Paul S. Bird, Andrew L. Bab and Spencer K. Gilbert of Debevoise & Plimpton LLP for counsel. San Francisco-based TPG turned to Jason S. Freedman and Minh-Chau Le of Ropes & Gray LLP.

The sponsors have obtained a $1.53 billion first-lien term loan and up to $425 million in second-lien term loans for the deal as well as a $300 million first-lien secured revolving credit facility from Deutsche Bank Securities Inc., UBS Investment Bank, BMO Capital Markets and Mizuho Securities USA LLC. Debevoise’s Scott Selinger is financing counsel to TPG.

Debevoise’s Scott B. Selinger is counsel on the financing.

Debevoise is long-time counsel to CD&R and recently advised on a deal to reacquire Cornerstone Building Brands Inc. (CNR) for $5.8 billion, announced in March, and the purchase of PricewaterhouseCoopers LLP’s global mobility tax and immigration services business, in October, among others.

Bird was M&A counsel on both deals, while Selinger provided legal advice on the financing of the PwC deal, which was reportedly valued at $2.2 billion.

CD&R invested in Covetrus predecessor Vets First Choice in 2015, a deal Debevoise also advised. In 2020, the firm made a $250 million perpetual convertible preferred investment in Covetrus in 2020, and again looked to Debevoise for counsel. Vets First merged with the animal health business of Henry Schein Inc. (HSIC) in a 2019 Reverse Morris Trust transaction to form Covetrus.

Ropes & Gray, too, has a longtime relationship with TPG, having advised the buyout shop in its IPO in January, as well as other deals including TPG portfolio company Wind River Systems Inc. on a $4.3 billion agreement to sell to Aptiv plc (APTV) in January and the acquisition of a 30% stake in DirecTV Group Inc. from AT&T Inc. (T) in 2021.

On the latest deal Deutsche Bank used Christoffer Adler, Eric Leicht and David Ridley of White & Case LLP for financing counsel. UBS looked to Jonathan J. Frankel, Javier Ortiz and Thomas Coombs of Cahill Gordon & Reindel LLP, and BMO tapped Stephen M. Kessing and Matthew Kelly of Cravath, Swaine & Moore LLP. Mizuho turned to Cahill’s Elizabeth Yahl, Keith Marantz and Charlotte Rehfuss.

Covetrus turned to Michael J. Aiello, Amanda Fenster and Megan Pendleton of Weil, Gotshal & Manges LLP for counsel and Craig Smart and Naomi Wender Leslie at Goldman, Sachs & Co. and Roderick O’Neill at Lincoln International LLC for financial advice.

At the company, CEO Benjamin Wolin, interim general counsel Margaret Pritchard and head of corporate development and strategy Cameron Foster worked on the deal.

CD&R partners Sarah Kim and Ravi Sachdev along with principal Jack Robinson are on the investment. At TPG partners Jeffrey Rhodes and Kendall Garrison are on the investment and general counsel Deirdre Harding is on the legal side.

TPG’s Sachdev is a Covetrus director and served on the board of Vets First Choice.