Wachtell Lipton’s Gregory Pessin is advising Broadcom on the $32 billion in financing for the deal, while Cahill Gordon & Reindel LLP is working with the banks. Chief legal and corporate affairs officer Mark Brazeal and deputy general counsel Connie Chen worked on the deal at Broadcom.

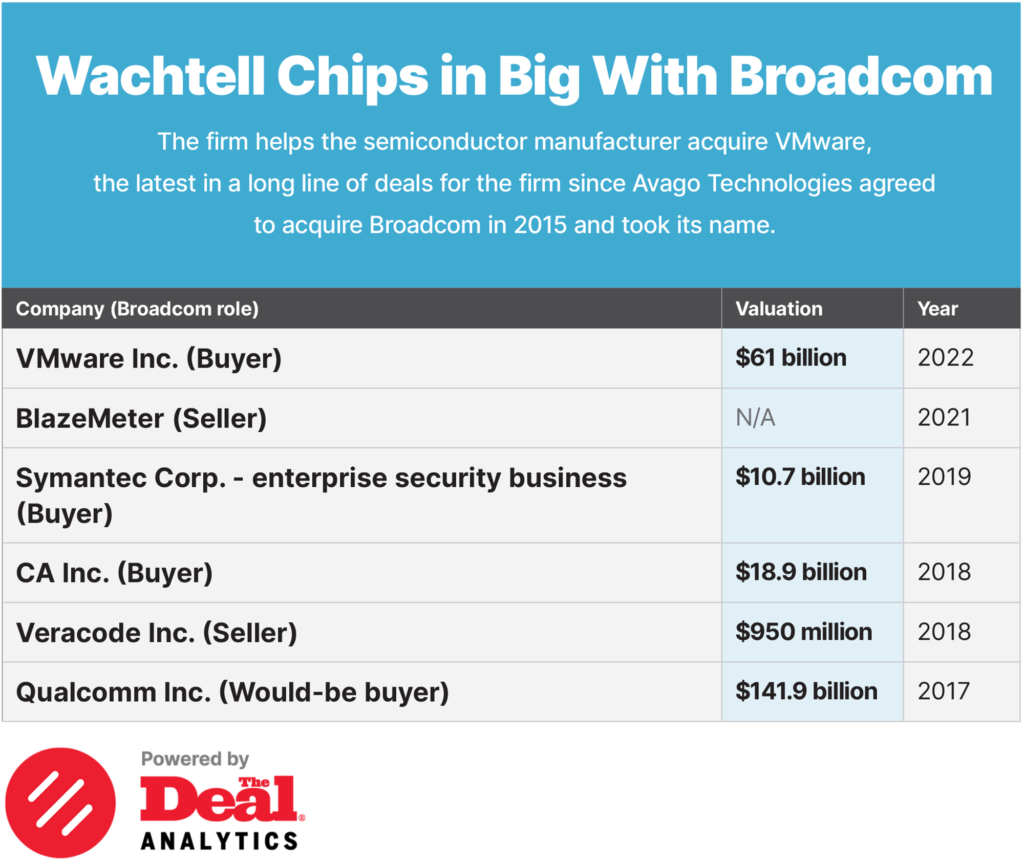

Wachtell Lipton advised Broadcom on its 2019 purchase of Symantec Corp.’s enterprise business and its $18.9 billion purchase of CA Inc. and its $950 million sale of Veracode Inc. to Thoma Bravo LP, both 2018 deals. The law firm also represented the company on its 2018 hostile bid for Qualcomm Inc., an effort killed by Cfius.

Silver Lake Partners, which owns 10% of VMware, turned to Atif Azher, William Dougherty and Naveed Anwar of Simpson Thacher & Bartlett LLP for counsel. Co-CEO Egon Durban, managing directors Joerg Adams and Kyle Paster and principal Arian Khansari are on the investment at Silver Lake, where chief legal officer Karen King and general counsel Andrew Schader are on the legal side.

Michael Dell, who owns 42% of VMware, turned to Steven Rosenblum and Gordon Moodie at Wachtell Lipton. Rosenblum advised Michael Dell and his investment vehicle MSD Capital on the 2014 buyout of Dell Inc. and on Dell’s purchase of EMC. Michael Dell teamed with Silver Lake on the buyout.