Kite Realty Group Trust (KRG) on July 19 agreed to combine with rival shopping mall operator Retail Properties of America Inc. (RPAI) in a deal that will create a company with an enterprise value of about $7.5 billion.

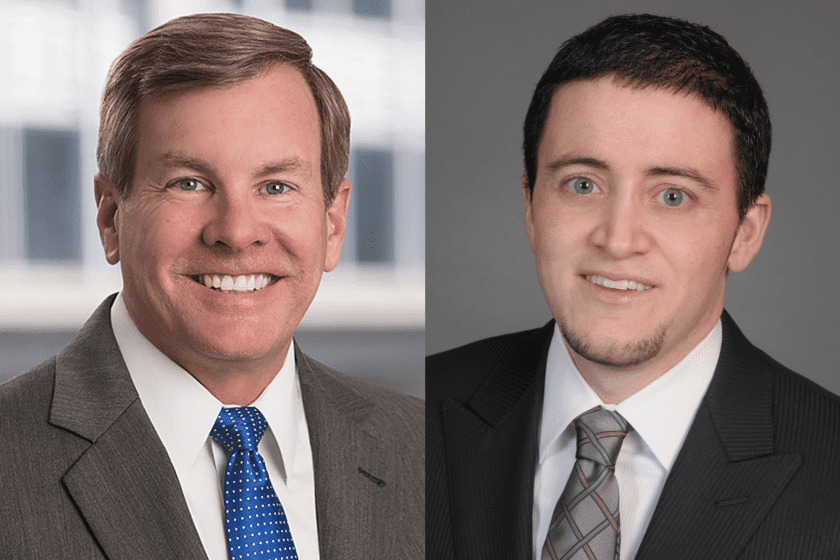

Indianapolis-based Kite Realty turned to David Bonser, Paul Manca and Cristina Arumi of Hogan Lovells US LLP for counsel and took financial advice from Jack Vissicchio and Ben Lett at BofA Securities Inc. and David Gordon at KeyBanc Capital Markets. Bonser and Hogan Lovells’ J. Warren Gorrell Jr. advised Kite on its 2004 IPO, and Bonser and Manca represented the company on its $2.1 billion purchase of Inland Diversified Real Estate Trust Inc. in 2014.

Chicago-based Retail Properties of America turned to Blake Liggio, Gilbert Menna and Daniel Adams of Goodwin Procter LLP for counsel and Matthew Greenberger and Jens Thomas Jung at Citigroup Global Markets Inc. for financial advice. CEO Steven Grimes ran the deal at RPAI. Goodwin advised RPAI, then known as Inland Western Retail Real Estate Trust Inc., on IPO in 2012, when it assumed its current name.

Kite will pay 0.623 shares of its stock per RPAI share. At the buyer’s July 16 closing price of $20.83 per share, the deal values RPAI at about $2.7 billion, or $12.98 per share, a 13% premium to the target’s Friday closing price of $11.52 per share. On closing, which is expected in the fourth quarter of 2021, Kite shareholders will own about 40% of the combined company’s equity and RPAI shareholders about 60%.

Kite’s management team of CEO John Kite, president and COO Thomas McGowan and CFO Heath Fear will run the combined company, which will retain the Kite name and continue to be based in Indianapolis. Four members of the RPAI board will be added to the Kite board, which will expand to 13 directors.

The companies said in their release that after closing Kite will have an equity value of about $4.6 billion and an enterprise value of about $7.5 billion and will be one of the country’s five largest shopping center REITs by enterprise value.

After closing, Kite will have an operating portfolio of 185 open-air shopping centers with a total of about 32 million square feet of space. About 70% of the centers will have a grocery component, with 40% of annualized base rent in Florida and Texas.

Editor’s note: The original version of this article was published earlier on The Deal’s premium subscription website. For access, log in to TheDeal.com or request a free trial.