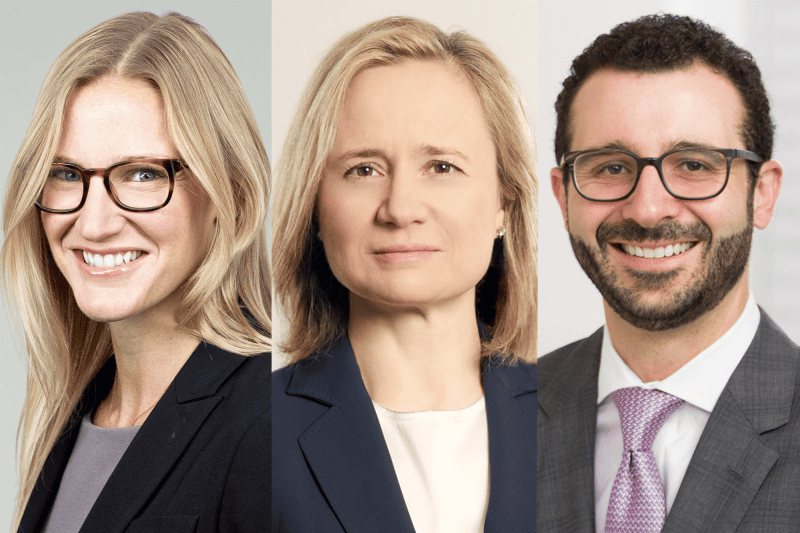

Kellanova Co. (K) turned to Eric L. Schiele, Allison M. Wein and Robert M. Hayward of Kirkland & Ellis LLP for counsel on an agreement to sell to Mars Inc. for $35.9 billion in cash and assumed debt in a deal announced on Wednesday, Aug. 14.

Timothy Ingrassia, Marko Ratesic and Bridget Chaudhry at Goldman, Sachs & Co. gave financial advice to Kellanova, whose board of directors turned to Adam Taetle, Jeff Thiesen and Brendan Shea at Lazard Ltd. for financial advice.

Chief counsel Todd Haigh and corporate counsel Sarah M. Hesse are on the in-house legal team on the transaction at Kellanova, a Chicago-based food and beverage company formerly known as Kellogg Co. Haigh practiced at Kirkland from 2000 to 2005, when he went in-house at the company.

Schiele and Wein advised then-Kellogg on its spinoff of WK Kellogg Co. (KLG) last year, a deal on which Goldman and Morgan Stanley provided financial advice. Kirkland has done other M&A work for the company, including its $600 million acquisition of Chicago Bar Co. LLC, maker of RXBAR, in 2017, and the firm has done a significant amount of capital markets work for the company.

Goldman’s Ingrassia advised Kellogg in 2019 on the $1.3 billion sale of some of its cookies, fruit and fruit-flavored snacks, pie crusts and ice cream cones businesses to Ferrero Group.

Howard L. Ellin, Neil P. Stronski and June S. Dipchand of Skadden, Arps, Slate, Meagher & Flom LLP were M&A counsel to Mars, while Simpson Thacher & Bartlett LLP was financing counsel to the food, beverage and petcare company. Leon Kalvaria, Barrett Frankel and Awais Kharal at Citigroup Inc. gave financial advice to Mars.

Simpson Thacher’s Catherine Burns, Cravath’s Tatiana Lapushchik and Cleary’s John Kupiec

JPMorgan Securities LLC and Citi are providing Mars with financing for the deal. Tatiana Lapushchik, Matthew M. Kelly, William V. Fogg and Douglas C. Dolan of Cravath, Swaine & Moore LLP are counsel to the banks.

The Mars in-house legal team on the deal included general counsel Stefanie Straub, general counsel – corporate Peter Seka, assistant general counsel corporate development Yolanda Jameson, general counsel – Mars Snacking Lisa Mather, associate general counsel – corporate Elizabeth Savard and assistant general counsel – employment Rebecca Clar. Seka moved to Mars from Skadden in 2005.

Skadden has done a number of deals for Mars, among them its purchases of Heska Corp. for $1.3 billion in 2023; VCA Inc. for $9.1 billion in 2017; Pet Partners in 2016; BluePearl Veterinary Partners LLC in 2015; and of the Iams, Eukanuba and Natura pet food brands from Procter & Gamble Co. (PG) for $2.9 billion in 2014 as well as the sale of its private-label pet food business to Arbor Private Investment Co. LP in 2018.

Simpson did the debt financing work for Mars on the VCA deal and has done other financing work for the company. Simpson’s Eric M. Swedenburg and Michael Chao advised the company on its purchases of Trü Frü in 2023, of a controlling stake in Strategic Pharmaceutical Solutions Inc. in 2021 and of Kind LLC in two separate deals in 2017 and 2020.

Mars will pay $83.50 per Kellanova share in cash, a 33% premium to the target’s 52-week high as of Aug. 2, before news of a possible deal broke.

The deal came after TOMS Capital Investment Management LP, led by co-founder and chief investment officer Benjamin Pass, had been engaging with Kellanova for months in talks about ways to improve shareholder returns, according to a person familiar with the situation. The investment firm typically works behind the scenes with companies it invests in but has been linked to some activist campaigns at major consumer companies in the past. The fund owned a 1.1% stake, or about 3.8 million shares, at the end of March, according to a May filing.

The companies plan to close the deal in the first half of 2025, pending approvals from regulators and Kellanova stockholders.

The W.K. Kellogg Foundation Trust and the Gund Family have agreed to vote shares representing 20.7% of Kellanova stock for the deal. The trust, Kellanova’s largest stockholder with a roughly 15% stake, turned to John A. Kupiec and Kyle A. Harris of Cleary Gottlieb Steen & Hamilton LLP for counsel.

—Ronald Orol contributed to this report