Tegna Inc.’s (TGNA) $8.6 billion sale to Standard General LP and Apollo Global Management Inc. (APO) marked another deal with the former Gannett Co. (GCI) unit and regular counsel at Wachtell, Lipton, Rosen & Katz.

Igor Kirman of Wachtell Lipton advised the Tysons, Va.-based broadcaster on a pair of proxy fights in 2020 and 2021, and he and Wachtell Lipton’s Andrew R. Brownstein, Viktor Sapezhnikov and Victor Goldfeld are counsel to Tegna on the Feb. 22 sale.

Marco Caggiano and Paul Finger at JPMorgan Chase & Co. and Scott L. Bok at Greenhill & Co. are giving financial advice to Tegna, whose general counsel is Akin Harrison. Jennifer Johnson and associate Hannah Lepow of Covington & Burling LLP were communications law counsel.

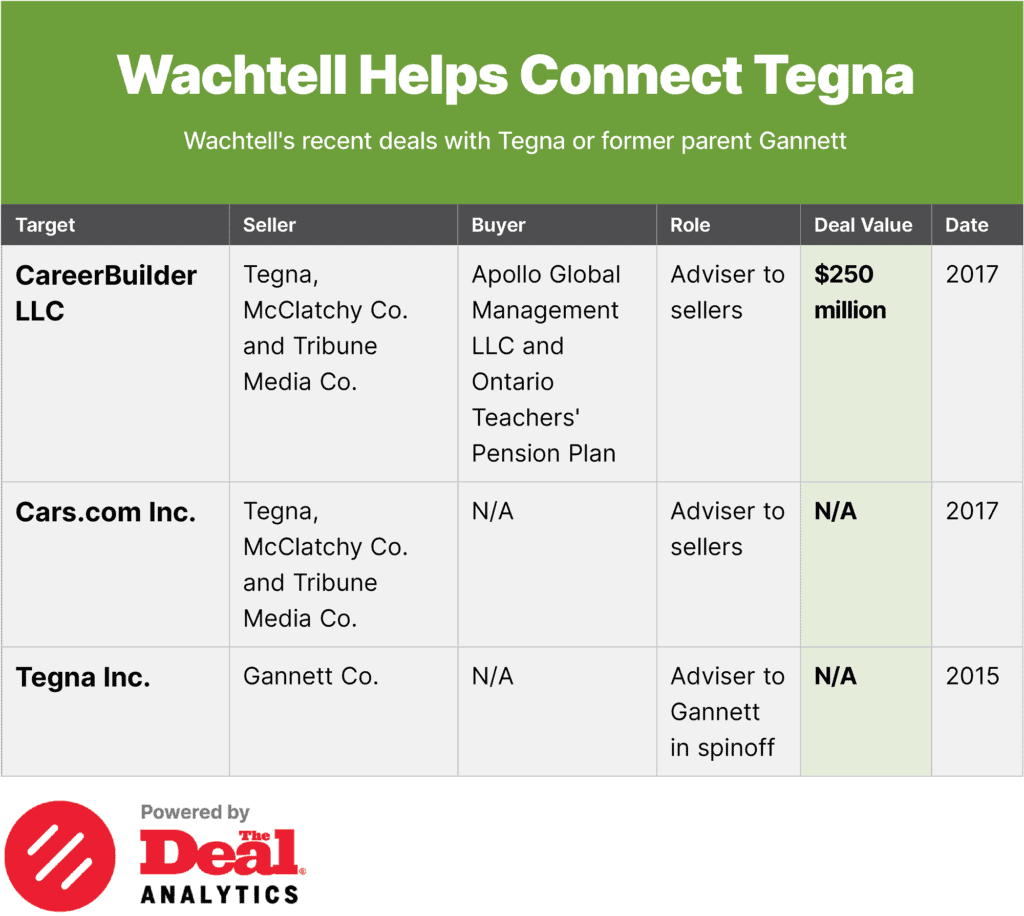

Wachtell and Greenhill advised Gannett when it spun out Tegna in 2015 and worked with Tegna, McClatchy Co. and Tribune Media Co. on the $250 million sale of a majority stake in CareerBuilders LLC to Apollo and Ontario Teachers’ Pension Plan as well as on the spinoff of Cars.com Inc. (CARS), both 2017 deals.

Standard General, which is based in New York, turned to Philip Richter of Fried Frank Harris Shriver & Jacobson LLP for counsel and John Momtazee, Adam Burnett and Larry Kennedy at Moelis & Co. LLC along with RBC Capital Markets for financial advice.

Gail Steiner is the general counsel and chief compliance officer at Standard General. Scott Flick is leading a Pillsbury Winthrop Shaw Pittman LLP team providing communications law advice. Fried, Frank also advised Standard on the proxy fights.

Richter advised longtime client Sinclair Broadcast Group Inc. (SBGI) on a $441.7 million agreement to sell nine television stations to Standard General affiliate Standard Media Group LLC in 2018, a deal that fell through when regulators killed Sinclair’s deal for Tribune Media. Pillsbury’s Flick represented Standard Media when it bought nine television stations from Vision Communications LLC and Waypoint Media LLC for $59 million in 2019.

Apollo, which will hold nonvoting securities in Tegna after the deal closes, tapped Taurie M. Zeitzer and Brian Scrivani of regular counsel Paul, Weiss, Rifkind, Wharton & Garrison LLP for legal advice.

The deal brings to a close a more than two-year saga for Tegna and Standard General that included a pair of proxy fights and a number of unsolicited bids. As recently as September, Byron Allen’s Allen Media Group LLC was also considering a bid.

Request a demo of The Deal Analytics.

Editor’s note: The original version of this article was published earlier on The Deal’s premium subscription website. For access, log in to TheDeal.com or use the form below to request a free trial.