M&A

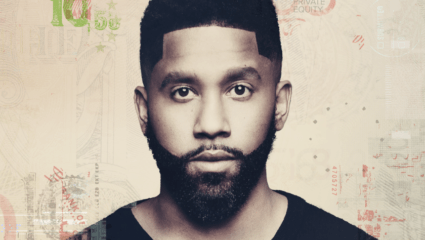

Drinks With The Deal: MIT's Will Deringer

By David Marcus

|

Published: January 28th, 2021

The MIT historian of finance talks about what he learned from his time as a Blackstone analyst, Michael Milken and early spreadsheet programs, the South Sea Bubble and the many uses of present value in this week's episode.