The U.S. Labor Department’s new proposal making to more difficult for retirement plan providers to vote on environmental, social or public policy agendas is a rifle shot against ESG.

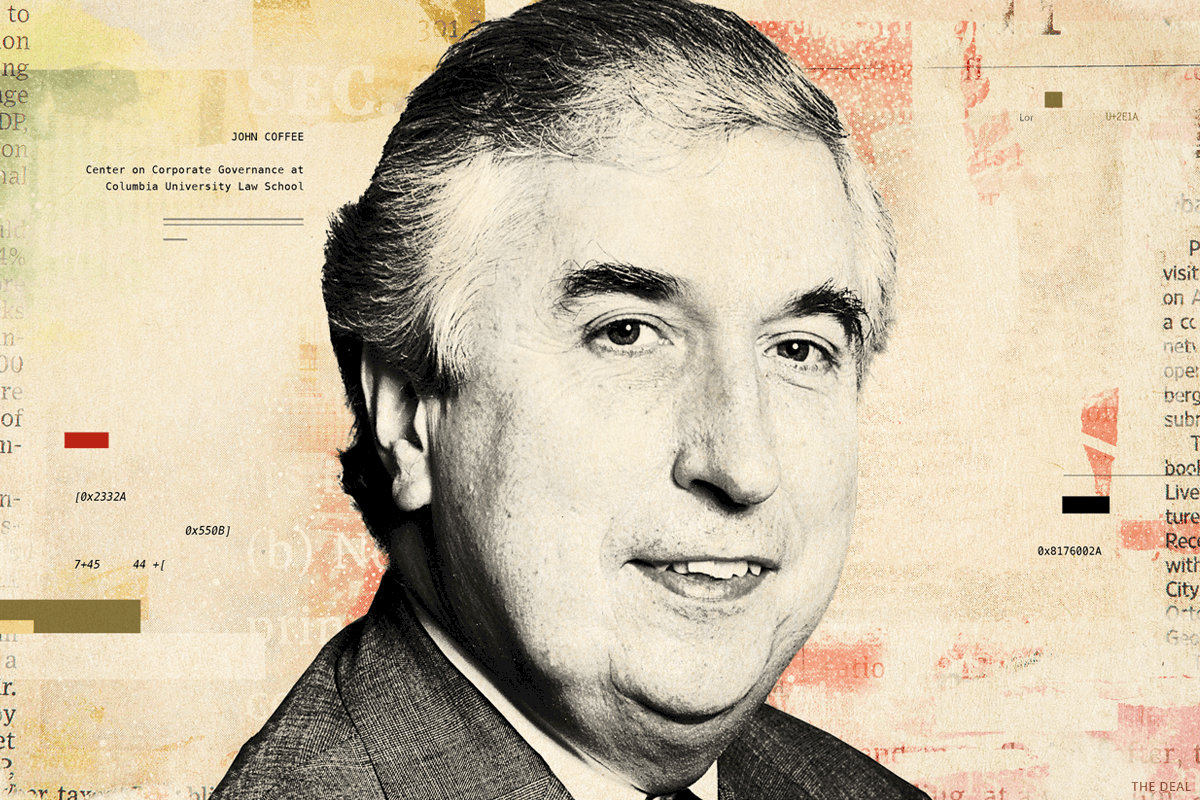

That’s according to Columbia Law School professor John Coffee, speaking in an interview in the latest episode of the Activist Investing Today podcast. Coffee discussed the Labor Department’s new draft ESG voting rules as well as why he thinks the Supreme Court will likely poke its head into a new California law requiring companies headquartered in the state to install board members from “under represented” communities.

Coffee pointed to a provision in the Labor Department proposal noting that a plan fiduciary should not vote a proxy if the investment is small in terms of the plan’s total assets. In addition, the measure seeks to prohibit voting on proposals where the investor finds that there is no financial impact on the plan.

“If you look at large index investors… they have very small amount of assets in a particular company,” Coffee said of State Street Corp., Vanguard Group, BlackRock Inc. (BLK). “That it makes it hard to vote in anything related to a single company.”

He added that retirement plan administrators might be prohibited from voting on a non-binding proposal that asks a company to take greater action to diversify the board.

“Under the new rules you can’t vote on that because the vote won’t have a financial impact on the plan,” Coffee said.

Coffee also notes that a new SEC rule targeting shareholder proposals will work “hand in glove” with the Labor Department proposal, if adopted. A separate measure seeking to reduce investor position disclosures, would, if adopted represent “a huge retreat from transparency,” as well, he said.

Coffee also discussed a recently adopted SEC rule that will instal tough restrictions on proxy advisers Institutional Shareholder Services Inc. and Glass, Lewis & Co. He said the news rules could produce a fair amount of litigation.

Here’s the podcast:

This and more of The Deal’s podcasts are available on iTunes, Spotify and on TheDeal.com.