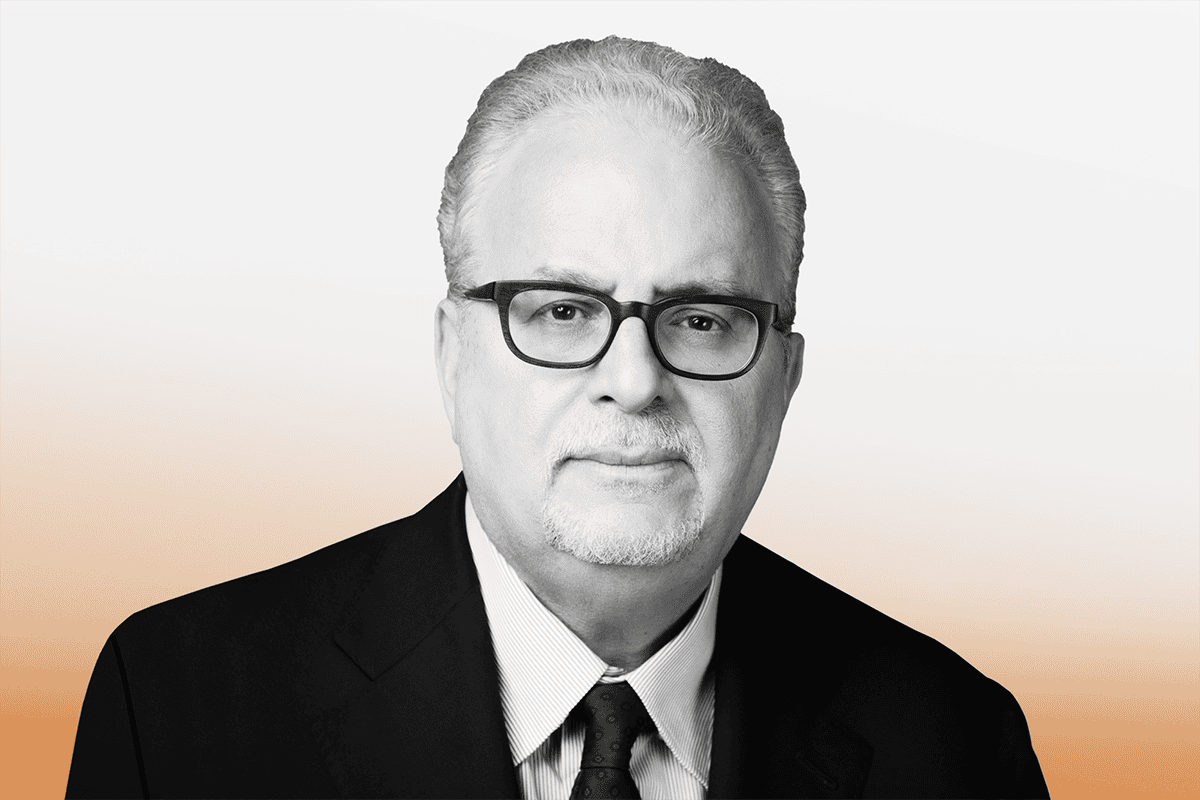

Issues that may not have been viewed as concerning for director candidates 10 years ago may really resonate now with shareholders, according to Dan Nardello, founder of business intelligence and investigations firm Nardello & Co.

“There is a danger of hiring someone, doing a background investigation and not refreshing it ever so often, because things change,” Nardello told the Activist Investing Today podcast, in an interview partly focused on why companies should vet existing directors periodically to avoid the kinds of “low-lying vulnerabilities” that an activist investor might later pounce on.

“One example is MeToo issues and constellation of things that came out of that,” he said. “Abusive behavior, anger management, intemperate remarks may have been tolerated 10 or 15 years ago in a way that is no longer acceptable.”

Nardello discussed the kinds of investigations his firm conducts on corporate boards in peacetime and when activist investors show up.

“An ounce of prevention is worth a pound of cure. If we can help a company onboard folks who don’t have low-lying vulnerabilities, half our job is done,” he said.

Use of company jets, inconsistencies between resumes and actual accomplishments, including concerns stemming from gaps in resumes, worries related to use of social media by director candidates’ spouses and families, and problematic corporate credit card use are all topics that also came up.

Check out the podcast with Dan Nardello below:

More podcasts from The Deal are available on iTunes, Spotify and on TheDeal.com.