As market volatility proliferates in the wake of the coronavirus outbreak, many funds of all shapes, sizes and ilks that had contemplated activism are likely to walk away. Meanwhile, established activist investors such as Carl Icahn will build stakes and pursue insurgencies.

That’s the lay of the land for activism during the unfolding pandemic of Covid-19, the disease caused by a novel coronavirus, according to Lawrence Elbaum, partner and co-head of Vinson & Elkins LLP’s shareholder activism practice.

“There will be plenty of hedge funds, first-time activists, family offices, private equity funds, who have been contemplating activism this season who are going to walk away from campaigns due to a host of pressures,” Elbaum said. “Some will be external, market-driven pressures: ‘It is too expensive to run a campaign, unlock value, this is not the time or industry to run a fight.'”

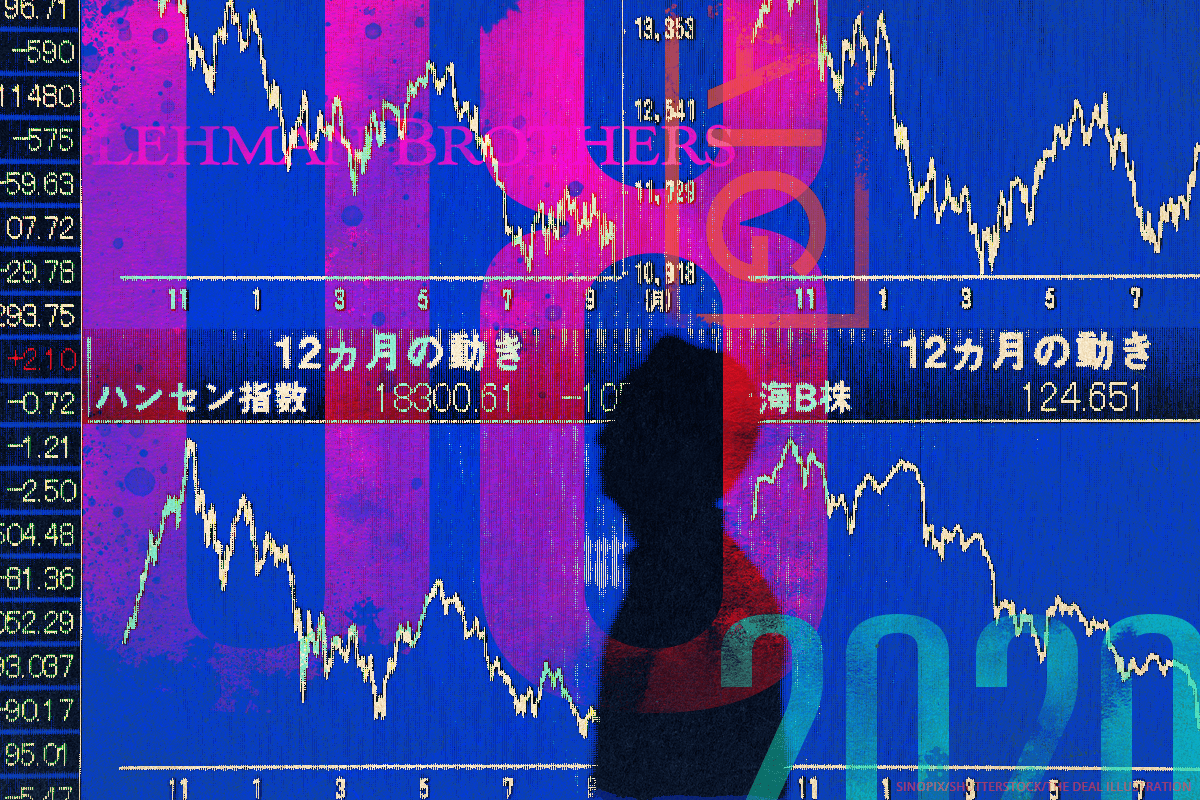

Elbaum on The Deal’s Activist Investing Today podcast spoke about why some activists will double down on their campaigns while others will cancel their efforts. He also discussed what the 2008 financial crisis and subsequent months can teach us about how activists might perform in the months to come and what steps companies trading at severe discounts to intrinsic value can do to fend off opportunistic activists, unsolicited acquirers or, in some cases, both.

Elbaum, however, also suggested that institutional activists who have “seen this movie before” will likely launch new campaigns and press forward with current campaigns.

“They don’t want to be looked at as giving up a campaign over something that might be viewed in hindsight as episodic hysteria over coronavirus or potential macro changes in energy price environment.”

Here’s the podcast:

This and more of The Deal’s podcasts are available on iTunes, Spotify and on TheDeal.com.