Activist investors no longer need to be Gordon Gekko to win a director contest.

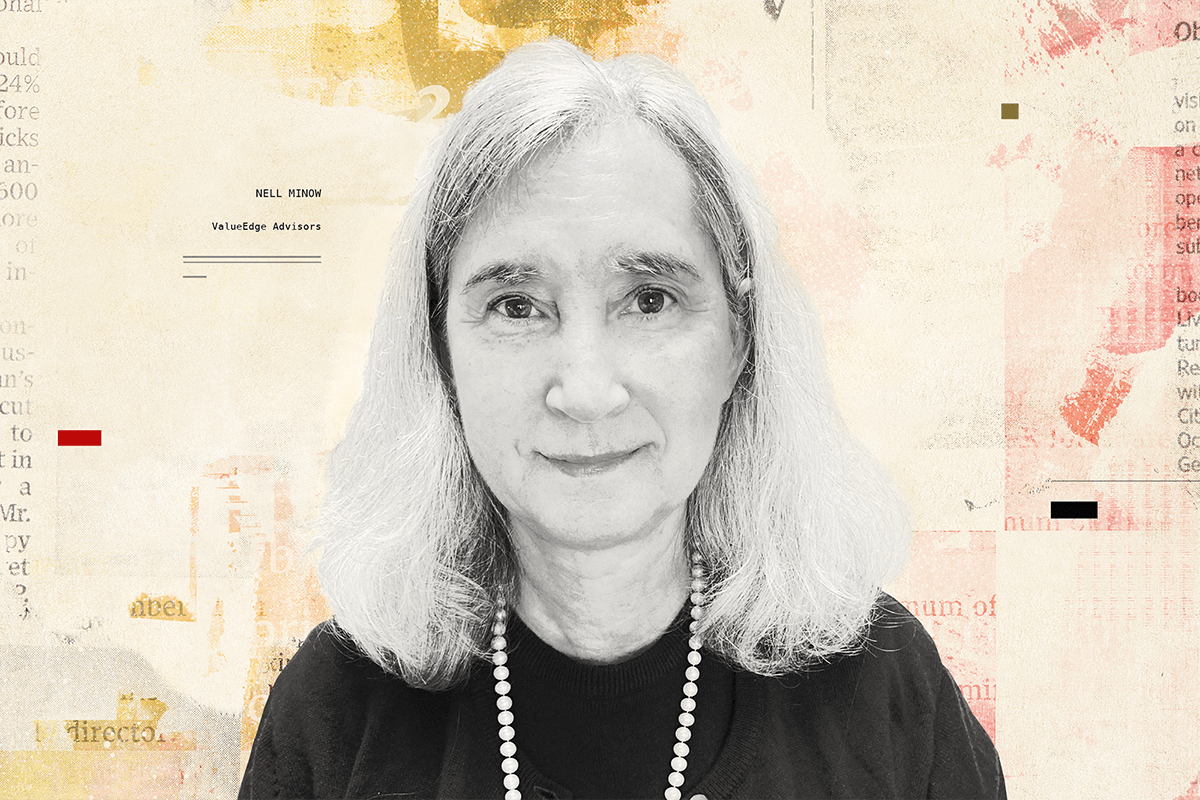

That’s the view of Nell Minow, a former activist investor who also helped form influential proxy adviser Institutional Shareholder Services Inc.

Minow, who spoke with The Deal for its Activist Investing Today podcast, sought to contrast the corporate raider-type character played by Michael Douglas in the 1987 classic film “Wall Street” with a new form of director election activism with an ESG twist that she expects to seem emerge following a surprisingly successful contest that concluded last month at Exxon Mobil Corp. (XOM).

The activist at Exxon, Engine No. 1, installed three of four dissident director candidates, including two renewable resource experts, on the board of the company with a nearly $265 billion market capitalization, despite only owning 0.02% of the stock.

“You want to think about Michael Douglas’ Gordon Gekko, we had someone like Carl Icahn who would come in with a 5% stake and would say, ‘Greed is good and these people are wasting your money and I’m going to sell the company,’” Minow said. “But after Engine No. 1, you will see that you don’t need to be Gordon Gekko to win a proxy contest anymore.”

Minow, vice chair at corporate governance consulting firm ValueEdge Advisors, argued that ESG — environmental, social and governance — activism is a better predictor than generally accepted accounting principles of investment risk.

“ESG increasingly is understood as an essential element of securities analysis because it evaluates risk better than any other metrics we use,” she said. “If there was a single corporation in America that in 2019 had as part of its agenda for board meetings the possibility of a worldwide pandemic and how they would respond to it, I would be very, very surprised. ESG-based analysis will bring those questions into the boardroom.”

Minow said she expects to see more director contests with an environmental or social theme to follow Engine No. 1’s Exxon campaign because “success breeds more success.” She added that smaller shareholders will be emboldened in the contest’s wake.

Check out the podcast here:

More podcasts from The Deal are available on iTunes, Spotify and on TheDeal.com.