Activist Investing Today: Moelis' Herrington Talks Proxy Votes, Boards After Exxon

Corporations in all sectors need to be prepared to engage with supersized index fund managers BlackRock Inc. (BLK), Vanguard Group Inc. and State Street Corp. (STT) on environmental, governance and social issues as part of a regular dialogue.

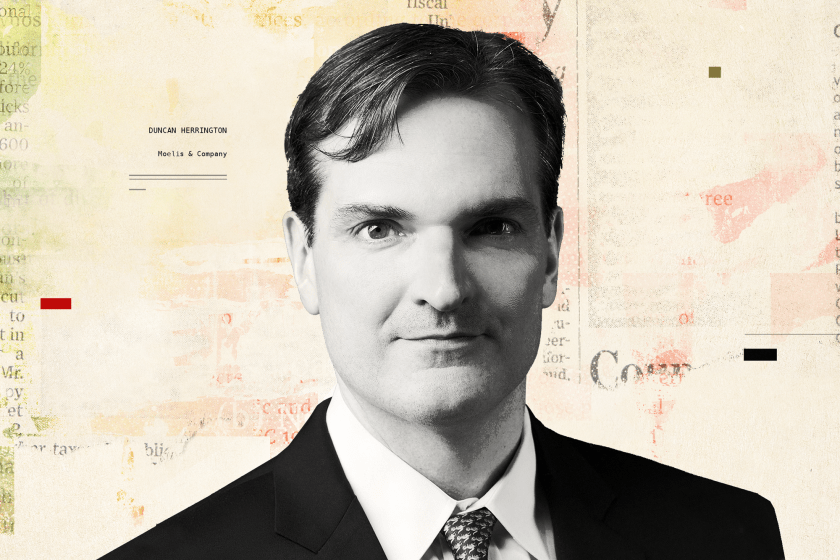

That’s the view of Moelis & Co. LLC activism defense managing director Duncan Herrington, who spoke with the Activist Investing Today podcast about corporate director selection efforts following ESG activist Engine No. 1’s big win installing three directors, including two renewable resource experts, at Exxon Mobil Corp (XOM).

Herrington said he didn’t believe it was absolutely necessary for companies to “carte blanche” have environmental technical experts on their boards. He said, however, he believes it is paramount for investors to understand that directors as a whole know what ESG risks are financially material to the business.

“[Corporate boards] could have industry expertise and consult with outside experts on ESG issues and talk to shareholders, management and other directors or bring in an energy transition expert,” Herrington said. “As long as you are discussing those risks regularly with management and setting the right long-term strategy and gauging progress against your peers, and supporting or challenging management on it as necessary.”

Duncan Herrington also discussed just how influential proxy advisers Institutional Shareholder Services Inc. and Glass, Lewis & Co. LLC are on voting outcomes, including on ESG matters.

He examined the growing role and importance of environmental-focused ratings issued by a variety of companies, as well as the possibility of activists targeting U.S. corporations that lack gender or demographic diversity on their boards.

“Voting outcomes are highly correlated with proxy adviser recommendations,” Herrington said. “Winning ISS and GL is a strong bellwether of success.”

Check out the podcast here:

More podcasts from The Deal are available on iTunes, Spotify and on TheDeal.com.