Activists are being intellectually dishonest about their intentions at companies if they don’t disclose their M&A plans for targeted companies, Lawrence Elbaum said.

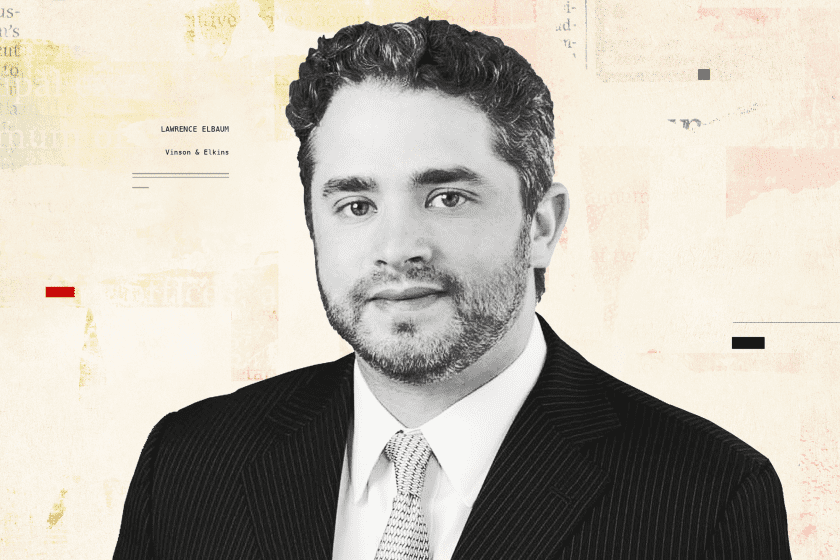

The co-head of Vinson & Elkins LLP’s shareholder activism practice on the Activist Investing Today podcast spoke about the intersection of activism and deals as well as his expectations for both Kohl’s Corp. (KSS) and Twitter Inc. (TWTR).

“M&A is definitely on the minds of activists. I don’t think it serves activists well to be intellectually dishonest about their M&A intentions,” Elbaum said. “It behooves them to be above board about their intentions, whether that is public or private, in dealings with the company.”

Elbuam added that he expects Macellum Advisors GP LLC, an activist investor targeting Kohl’s, to return to the chain in 2023 or earlier with another campaign, after the department store chain canceled an auction after walking away from talks with a strategic buyer. Macellum lost a change-of-control contest at Kohl’s in May.

“The companies where a sale is a key theme, such as Kohl’s, the boards there did not know that the stock would be where it is at now when they were making strong statements about how thorough their process was and how great they were proceeding as fiduciaries,” Elbaum said. “For companies like that, which may have declined to do a deal at prices that make a lot of sense looking [in] hindsight, they will have to do a very good job explaining to shareholders next year why that deal was not actionable.”

He added that Kohl’s directors are very vulnerable in light of Kohl’s trading price, following the abandonment of the auction. “I’m surprised the activist hasn’t come out demanding board seats now, saying, ‘Give us board seats, we’re definitely going to get them next year,’” Elbaum said.

Elbaum also said he thought it was very possible that Elon Musk is seeking to cancel his acquisition of Twitter as a means to an end. The billionaire Tesla Inc. (TSLA) CEO earlier this month called off his $44 billion acquisition, which prompted Twitter to file a lawsuit in the Delaware Court of Chancery seeking to compel him to close the deal.

“I think Elon Musk at the end of the day still wants the business but wants to pay less for it and is using the tool of termination that would draw litigation as a business strategy to get a price he’s more comfortable with for the asset,” Elbaum said. “He probably believes, correctly so, that he is the market for this asset and has pricing power.”

Elbaum also said he expects electric mobility companies that were taken public via special purpose acquisition companies and are trading significantly below their IPO price will face a wave of consolidation and, possibly, activist proxy contests.

“Some of these companies have real IP and are trading below the cash on their balance sheet,” he said.

Check out the podcast with Lawrence Elbaum below:

More podcasts from The Deal are available on iTunes, Spotify and on TheDeal.com.