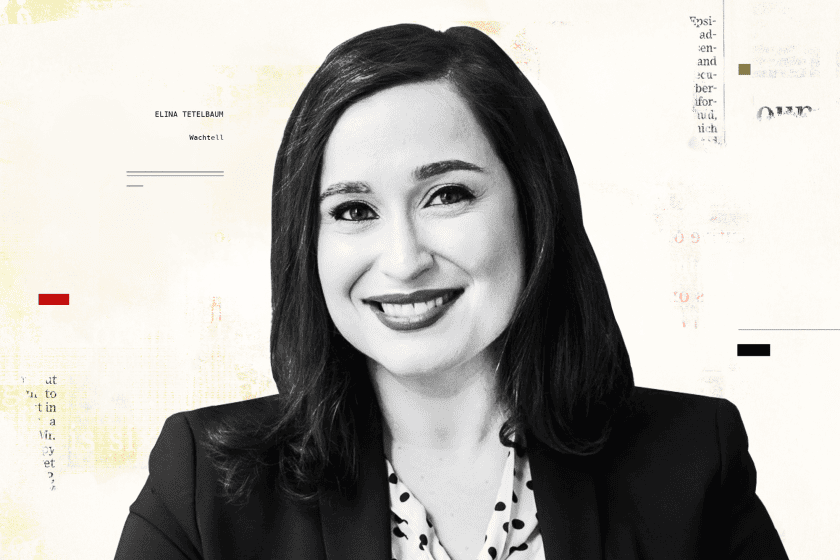

Nondisclosure agreements reached between activists and corporations are often viewed as perfunctory documents, but they’re typically very powerful contracts that set the tone for an entire insurgency situation, Wachtell Lipton Rosen & Katz partner Elina Tetelbaum argued on the latest Activist Investing Today podcast.

“NDAs are usually one of the first documents that get negotiated,” she explained, referencing settlement negotiations that frequently occur between investors agitating for change and companies.

On AIT, Tetelbaum, who advises companies targeted by activists, offered a behind-the-scenes look at when NDAs are typically struck, as well as the kinds of trading and campaigning restrictions they often include.

“A confidentiality agreement will often have a provision in it explaining that the existence of the confidentiality agreement is secret so you may never know anything about it,” she said.

In other cases, she explained, some details are offered, as with Walt Disney Co.’s (DIS) NDA reached in January with ValueAct Capital Management LP. Tetelbaum explained why Disney might have struck that information sharing arrangement, though she also expressed some reservations with the strategy.

Check out the podcast with Elina Tetelbaum below:

More podcasts from The Deal are available on iTunes, Spotify and on TheDeal.com.