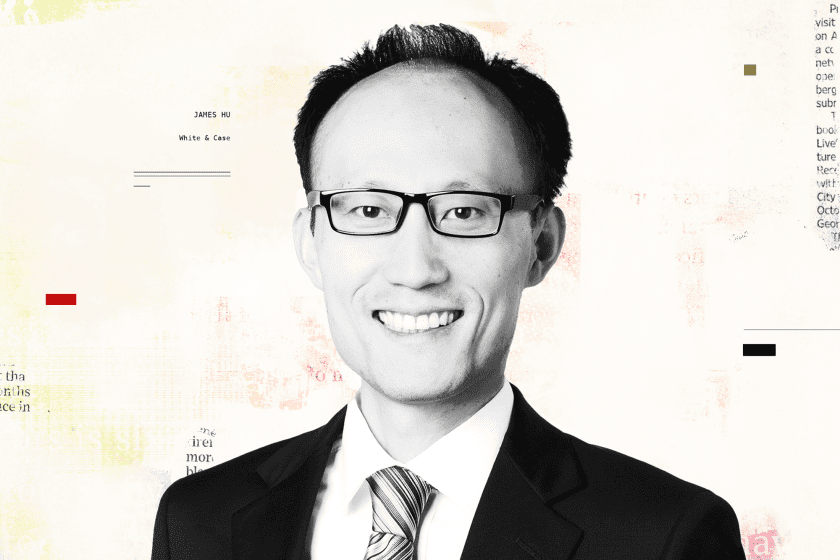

Activist Investing Today: White & Case’s Hu Talks M&A’s Unintended Consequences

Removing a buyer shareholder vote enhances closing certainty, though the action could be used by activists to oppose a transaction, White & Case LLP partner James Hu explained on the latest Activist Investing Today Podcast.

“If the buyer’s usual [director] nomination window for the annual shareholder meeting overlaps with a deal’s execution timeline, its directors could be exposed to a proxy contest with an objection to the deal,” Hu said.

Hu explained why activists prefer M&A activism over operational campaigns, and he offered his views on new Schedule 13D disclosure implications on future insurgencies.

“The push for a sale transaction for an underperforming stock, if successful, will likely garner immediate short-term return for the activist investor due to the control premium in the sale,” Hu said. “Similarly divesting noncore businesses can create pure-play public companies that also trade at a higher valuation, in contrast to operational value-oriented campaigns which can take longer times to execute.”

Check out the podcast with James Hu below:

More podcasts from The Deal are available on iTunes, Spotify and on TheDeal.com.