Behind the Buyouts: Sun Capital's Leder Talks Post-Close Value Creation

Hello and welcome to Behind the Buyouts, The Deal’s podcast where we sit down with pros from the world of private equity and venture capital and drill down into their deals.

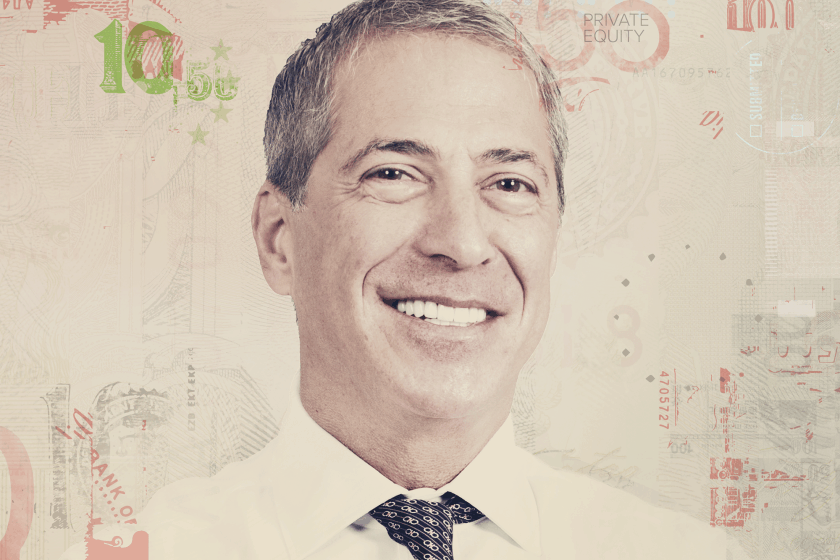

For our 15th podcast, Marc J. Leder, co-founder and co-CEO of Sun Capital Partners Inc., explained how he’s navigated the past quarter century of dealmaking. The Boca Raton, Fla.-based buyout firm has invested more than $13 billion since its founding in 1995.

While the firm continues to pay “reasonable prices” by taking an opportunistic approach to dealmaking, since 2013, he said, there’s been a greater onus put on how funds can create value after the deal is done.

“Candidly, nobody is getting bargains nowadays,” Leder said. “If you go back 10 or 15 years, you could make money on the buy and whatever you did post-closing added to your return.”

In recent years, it’s become more about what you do post-closing to improve efficiency, boost management or buy other businesses to add on to create investment gains for many portfolio companies, he said.

Sun Capital continues to seek out companies with some scratches or dings on them but have positive potential, as well as complete turnaround stories.

Leder talked about the firm’s deals in healthcare, bedding and its increased focused on technology companies, as well as the efforts of private equity firms to build up companies to create value, versus the public perception PE focuses more on laying people off and shutting down businesses.

Here’s the podcast:

More podcasts from The Deal are available on iTunes, Spotify and on TheDeal.com.