Activist hedge funds hurt research & development budgets at U.S. corporations.

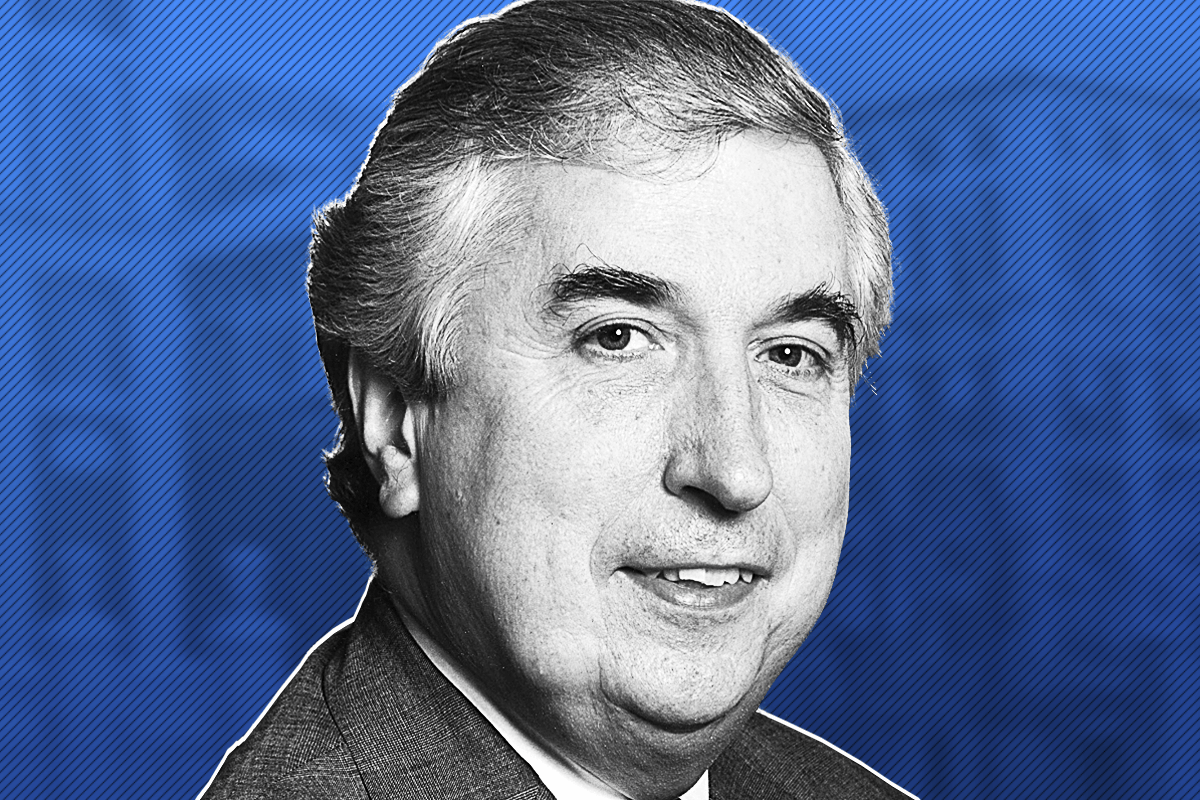

At least that’s the view of Columbia Law School Professor John Coffee, who spoke with The Deal for its Activist Investing Today podcast about a study he co-authored on the impact of insurgent managers on corporations and the markets overall.

In a wide-ranging conversation, Coffee explained what he thinks is going on with Carl Icahn’s objections to Occidental Petroleum’s acquisition of Anadarko Petroleum and what he thinks might be at play when activists try to nullify blockbuster mergers. Coffee, who runs Columbia’s Center on Corporate Governance, also discussed his thoughts on a new Securities and Exchange Commission effort seeking to rewrite the rules for proxy advisers Institutional Shareholder Services and Glass Lewis.

Here’s the podcast:

More podcasts from The Deal are available on iTunes, Spotify, and on TheDeal.com.