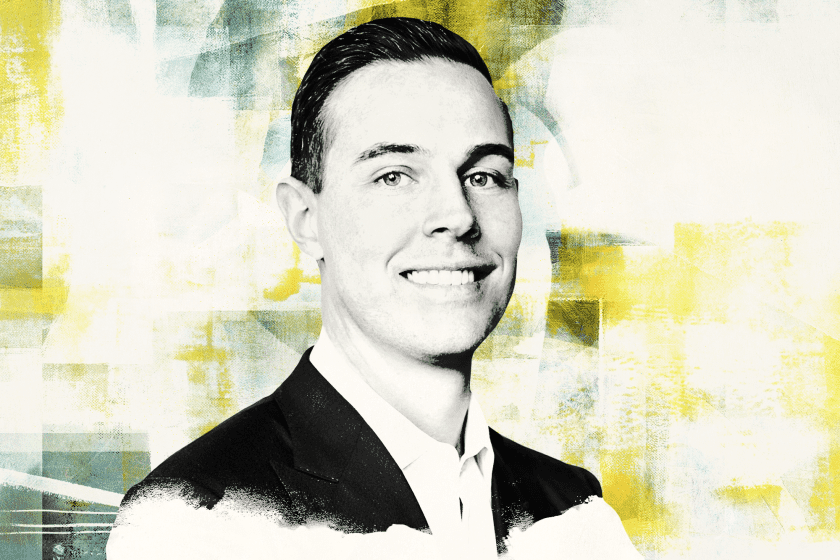

The demise of Silicon Valley Bank “is likely to make life much harder for startups,” Christopher R. Moore said on this week’s Drinks With The Deal podcast.

“It’s unlikely that a larger bank will be able to fill the void left by SVB” in the venture capital debt market, said Moore, an M&A partner at Cleary Gottlieb Steen & Hamilton LLP in the San Francisco Bay area. That absence “increases the likelihood that there will be down rounds and distressed M&A exits in the next six to nine months,” Chris Moore said.

He also discussed the effect of tighter lending markets on private equity deals in the software sector. Sponsors are responding in a number of ways, from financing deals entirely with equity in hopes of leveraging the portfolio company later or using fund-level debt facilities for portfolio company debt until the market improves and sponsors can move the debt down to the company level, he said.

Where target companies have favorable capital structures, sponsors are trying to preserve them in change-in-control transactions or selling a minority interest in the hopes of later selling a larger stake, Moore said.

Moore also discussed the effect of more vigorous antitrust oversight on how lawyers are drafting M&A agreements and thinking about divestitures as well as the possible effects of ChatGPT and similar AI technologies on legal practice.

Listen to the podcast with Chris Moore below:

More podcasts from The Deal are available on iTunes, Spotify and on TheDeal.com.