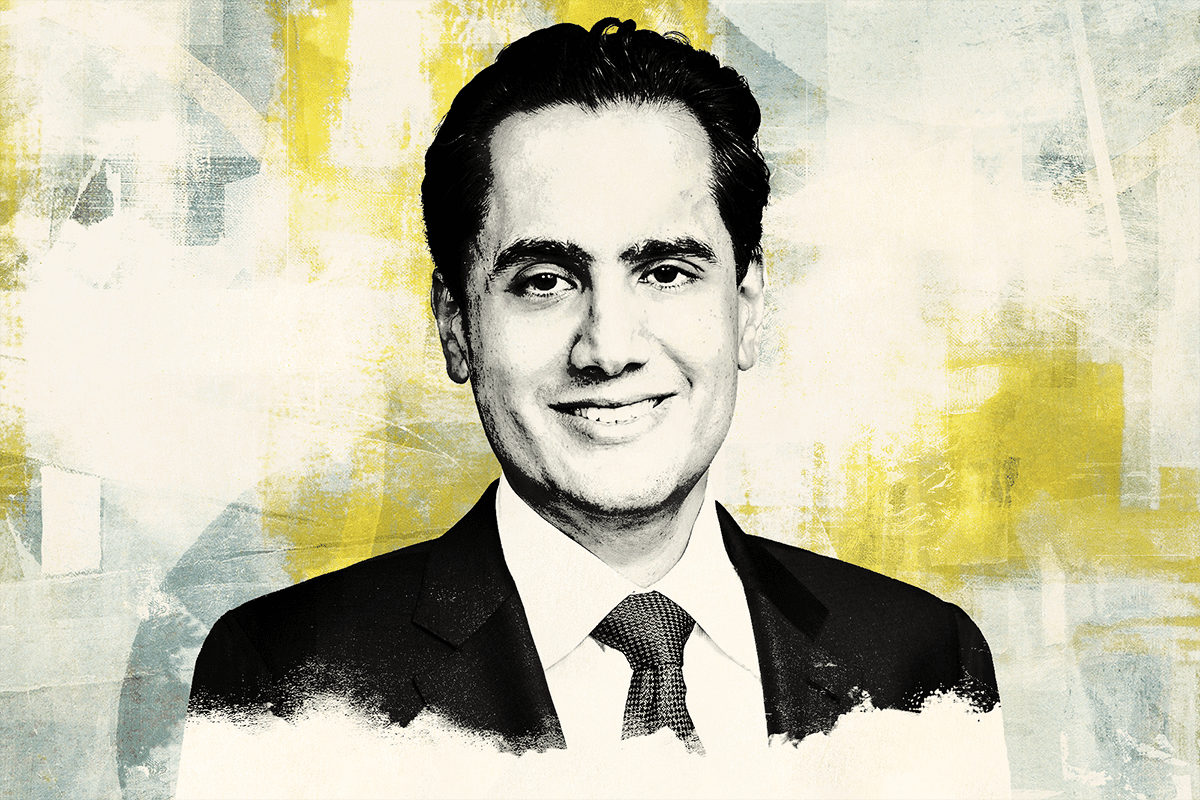

Eduardo Gallardo of Gibson, Dunn & Crutcher LLP believes the effects of recently adopted universal proxy card rules by the Securities and Exchange Commission will be significant.

“I think it’s a big deal,” he said on this week’s Drinks With The Deal podcast. “This is going to incentivize more activists to launch campaigns because their odds will be better of getting one or two members of their dissident slate on the board.”

On Nov. 17, the SEC approved rules giving institutional investors more flexibility to pick and choose incumbent and dissident director candidates on a universal proxy card.

“It’s going to increase the number of contests, it’s going to put a floor of one on any settlement discussions, and I think you should not understate the role it’s going to play with [proxy advisers Institutional Shareholder Services Inc. and Glass, Lewis & Co. LLC],” he said.

Gallardo discussed other aspects of shareholder activism on the podcast, including the lessons of the decision earlier this year in which the Delaware Court of Chancery ordered the board of Williams Cos. (WMB) to redeem a poison pill it installed at the start of the pandemic as well as the effect of ESG on how a board should consider shareholder value.

Here’s the podcast:

More podcasts from The Deal are available on iTunes, Spotify and on TheDeal.com.