More podcasts from The Deal are available on iTunes, Spotify and on TheDeal.com.

As an analyst at Blackstone Group Inc. (BX), William Deringer found the analysis he produced for more senior bankers advising clients on corporate restructurings “disingenuous,” he writes in his 2018 book “Calculated Values: Finance, Politics and the Quantitative Age.” Over time, he realized that “the numbers were not supposed to find the answer; they were supposed to make an argument,” a perspective self-evident to his older colleagues.

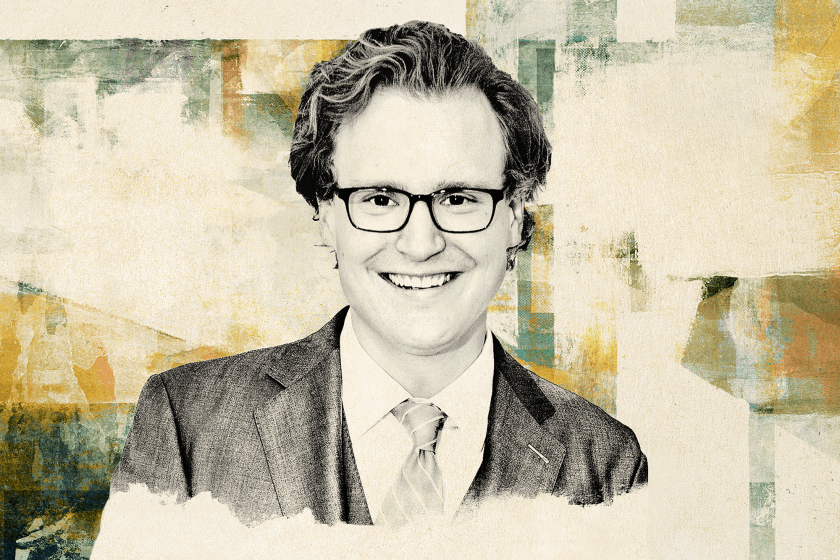

Deringer applied that insight in an unusual way, as he discusses in this week’s Drinks With The Deal podcast. Instead of staying in investment banking or going to business school, he became a graduate student in the history of science at Princeton University, from which he earned his doctorate in 2012. He’s now an associate professor of science, technology and society at the Massachusetts Institute of Technology, and in “Calculated Values,” his first book, he explored how numeric calculation became an important part of English political culture after 1688 “because of, not in spite of, its overt political affordances and applications.”

Last year, Deringer revisited the culture of Wall Street with an article on Michael Milken and his use of spreadsheets, then a novel technology, and one that helped financiers consider a much broader range of transactions than they had previously done, as Deringer explains on the podcast.

He’s also working on a history of the concept of present value, a calculation that mathematicians and financiers puzzled over for generations and has come to be applied in a wide array of contexts, including calculating how much society should spend to reduce the risk of climate change, Deringer says.

Here’s the podcast: