Everybody loves a second act.

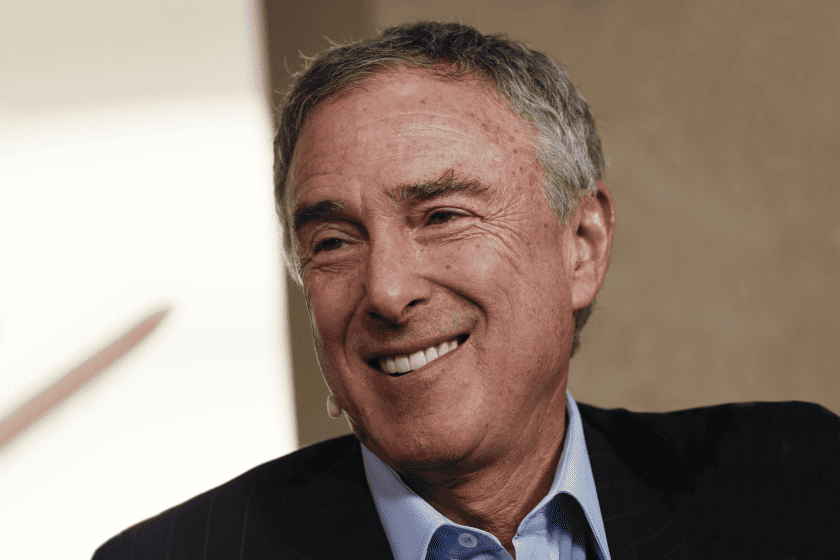

For SPAC sponsor Harry Sloan, that means going from hiring Tom Cruise to backing special purpose acquisition companies worth as much as $1.7 billion.

Sloan’s first career was in entertainment, as he was the chairman of Metro-Goldwyn-Mayer Studios Inc., trying to bring the Hollywood studio back from the dead. Sloan still sits on the board of Lions Gate Entertainment Corp. (LGF.A).

And sales of companies to investor Ron Perelman and private equity firms KKR & Co. and Permira gave him a taste of how Wall Street works.

On Drinks With The Deal, Sloan talked about the Securities and Exchange Commission trying to corral a runaway SPAC market and the regulator’s failure to enact 372 pages of proposed regulations. He also touched on his de-SPAC with DraftKings Inc. (DKNG), a digital betting marketplace that Sloan said has barely touched the surface of the amount of growth coming in the wagering business.

Sloan lamented the run-up in the SPAC market in 2021 and said 2022 included plenty of deals that shouldn’t have been done and plenty of companies not ready for primetime. “The year we did DraftKings, there were 30 or 40 SPACs. The next year there were 600.”

And while Sloan said he believes deeply in SPACs serving a purpose in bringing companies public, he revealed that for most companies, a traditional IPO is a better fit.

Listen to the conversation with Harry Sloan below:

More podcasts from The Deal are available on iTunes, Spotify and on TheDeal.com.