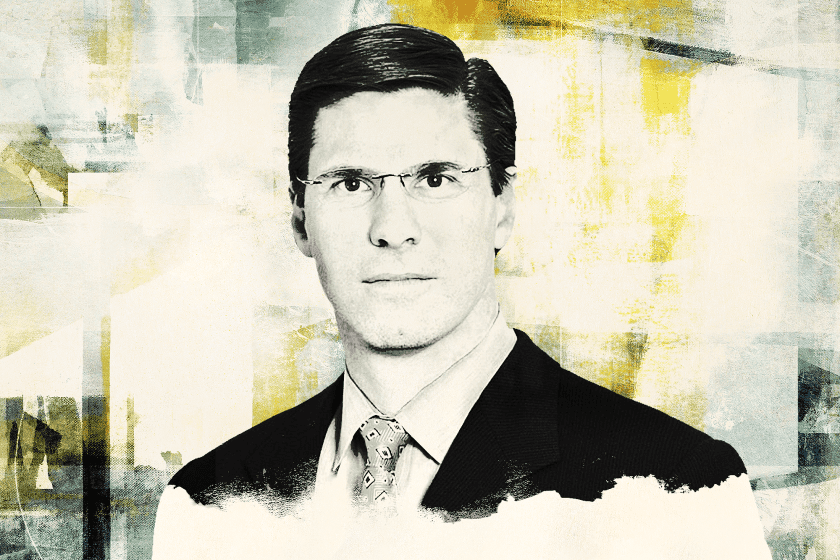

A stint as an in-house lawyer at US Bancorp (USB) in the 1990s shaped the way James Barresi thinks about financial services M&A, he said on this week’s Drinks With The Deal podcast. Barresi, who heads the financial services practice at Squire Patton Boggs LLP, said that former US Bancorp CEOs Jerry Grundhofer and Richard Davis taught him about “the business side of those transactions and understanding the strategic importance of evaluating a transaction, and that the hard work begins after closing when you have to integrate.”

Barresi, who worked with Sterling Bancorp (STL) earlier this year on a pending $10 billion merger of equals with Webster Financial Corp. (WBS), has brought those lessons to his work as an outside adviser. He’s built his team of lawyers at Squire Patton Boggs to include people with in-house and regulatory experience, and the group is “very much focused on becoming part of the internal team,” which includes doing due diligence with an awareness of the client’s concerns and what issues may be especially important in post-closing integration.

“You have to be careful about what deals you do in this space, because you don’t have an unlimited supply of arrows in your quiver,” Barresi said. “Regulators will only allow you to grow so far so fast. So it’s very, very important in analyzing a strategic transaction to understand how it fits into your strategic plan and what it might do to disqualify you from a future deal.”

Here’s the podcast:

More podcasts from The Deal are available on iTunes, Spotify and on TheDeal.com.