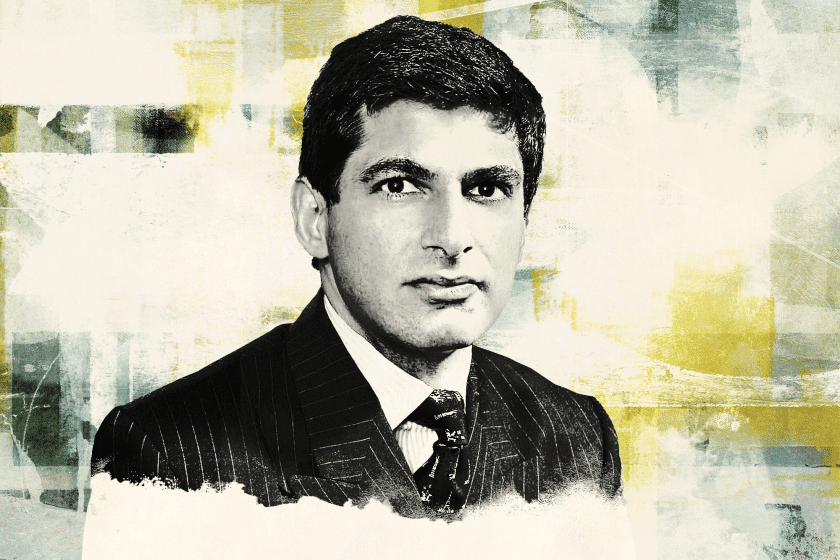

A decision involving a poison pill at Williams Cos. (WMB) was one of the most important issued by the Delaware Court of Chancery this year, and the opinion in the case was particularly interesting to Tariq Mundiya, as he discussed on this week’s Drinks With The Deal podcast. Mundiya, a partner at Willkie Farr & Gallagher LLP and head of the firm’s litigation practice, said there are parallels between the Williams case and a 2014 matter in which he advised Third Point LLC in challenging a poison pill adopted by the board of Sotheby’s during a proxy contest.

Mundiya advises both activist shareholders and companies, and when working with the latter group of clients, he always tells them, “You don’t want to be the test case,” he said — exactly the position Williams put itself in with the pill it adopted at the beginning of the pandemic.

Mundiya also discussed the evolution in Delaware law on the Caremark doctrine, which imposes oversight responsibilities on corporate directors, and on shareholders’ right to get access to corporate books and records under Section 220 of the state’s corporate code.

“I don’t think there has been a sea change in Caremark,” he said, “but I do think in these very specific, extreme cases, you are going to see judges be far more focused on making sure that the stockholders do get their day in court.” That trend has been helped by increased 220 access, which “used to be fairly narrowly circumscribed,” he said. “Now 220 demands are customary in any kind of corporate trauma case, of any securities litigation. You saw that used to great effect in the Boeing litigation,” a Caremark case that settled for $237.5 million in November.

Here’s the podcast with Tariq Mundiya:

More podcasts from The Deal are available on iTunes, Spotify and on TheDeal.com.