Talking M&A: Post-Merger Integration

Often an overlooked part of the M&A cycle, post-merger integration is becoming increasingly complex and an important consideration to discuss in the early stages of deal negotiations.

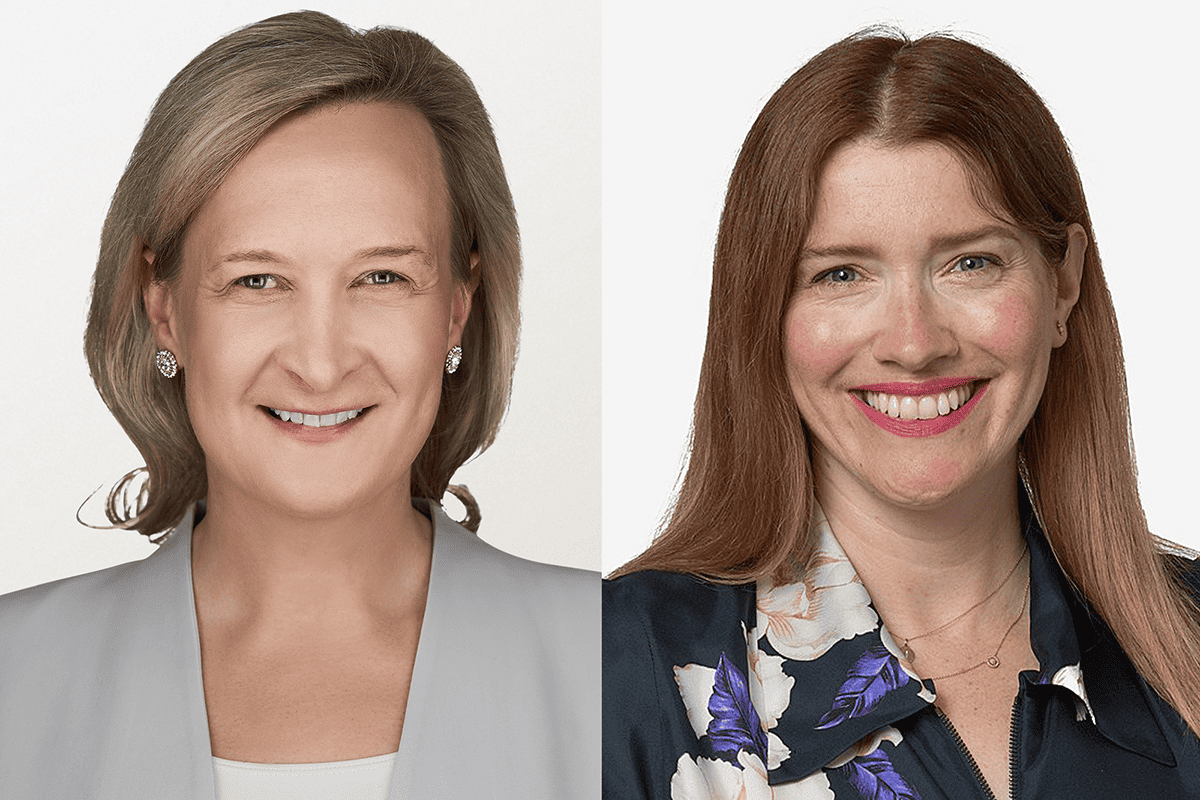

Both Helen Mantel and Jo Hewitt have extensive experience advising clients on designing and implementing the best integration plans and have witnessed a 20-year evolution in integration practices. Following the publication of Baker & McKenzie LLP’s 20th anniversary edition of its Post-Acquisition Integration Handbook, Mantel and Hewitt discuss the nuanced legal, financial and logistical complexities that companies must think about when embarking on any M&A journey.

“Once a deal closes, the buyer has actually purchased the potential for value creation,” said Mantel, adding “the next step is to make sure that the buyer yields that value, and this is often achieved by integrating the target business into the buyer’s existing business.”

Hewitt explained that while post-merger integration work is often thought of as coming after deal signing, it’s becoming increasingly necessary to carry out most of the post-acquisition planning before the deal closes. Specific considerations include corporate and employment law, tax drivers and commercial contract issues. “We’re often advising on those legal aspects, but very often we need to take a role that really helps clients navigate the practical considerations too,” Hewitt said, adding “every post acquisition will be somewhat different depending on the business and overall objectives of the acquisition.”

With Mantel based in Chicago and Hewitt based in London, both have unique local perspectives on specific deal considerations such as foreign investment review and ESG. Hewitt, however, said that as Baker McKenzie’s clients are often multinationals with global operations, the practice often requires taking a “truly global and overarching approach that takes local nuances into account.”

In addition, one of the biggest shifts over the past decade is that often the main driver of deal integration timelines is the IT department. This is a stark contrast to the landscape 20 years ago when tax or legal departments were the main drivers of timing. Additionally, Mantel explained that having a dedicated project management office in charge of the integration has been a “welcome development” over recent years to support successful and timely integrations.

Moving forward, both Mantel and Hewitt agree that companies must keep abreast of the changing regulatory environment, evolving ESG landscape and global operations when considering a potential M&A transaction — as without such consideration, there is a greater chance that a proposed deal value may not be realized.

The podcast was produced by The Deal, sponsored by Baker McKenzie and hosted by journalist Surani Fernando. Listen to the episode here:

More podcasts from The Deal are available on iTunes, Spotify and on TheDeal.com.

Editor’s Note: This podcast was sponsored by Baker McKenzie.