Middle-Market Digest: How Olympus Sourced Heniff and More

Hello, and welcome to The Deal’s Middle Market Digest, a review of notable developments from the private equity world between Thursday, Nov. 21 and Thursday, Dec. 5. This edition of the Digest encompasses two weeks instead of one because we skipped last week’s Digest due to the Thanksgiving holiday.

As always, this sampling spotlights transactions mainly below $500 million and includes deals from growth equity funds, family offices, middle market PE shops and more, all on the smaller side of the deal spectrum.

Olympus Partners LP pre-empted a sale process underway by Bank of America for its latest middle-market platform deal, Heniff Transportation Systems LLC, a source familiar with the transaction told The Deal. The Stamford, Conn. firm sourced the deal by embarking on a competitive sales process, “but some other things the firm brought to the party” related to other acquisitions helped it “jump the process a bit,” the person said. Olympus Partners on Tuesday, Dec. 3 announced its recapitalization of Oakbrook, Ill.-based Heniff Transportation Systems LLC, which operates 40 terminals in the U.S. as a liquid bulk transportation specialist. Bon Heniff, CEO of Heniff, along with other management, took part in the recapitalization. The Olympus team on the deal included Dave Cardenas, Griffin Barstis, Bryson Bono and Jordan Gershman. A Kirkland & Ellis LLP team including Benjamin Clinger, Matt Goulding and Travis Distaso advised Olympus Partners. Bank of America was financial adviser for Heniff. Olympus Partners typically invests $300 million or more for buyouts. It targets companies between $15 million and $125 million of Ebitda for both growth equity and buyout deals. Deal Memo

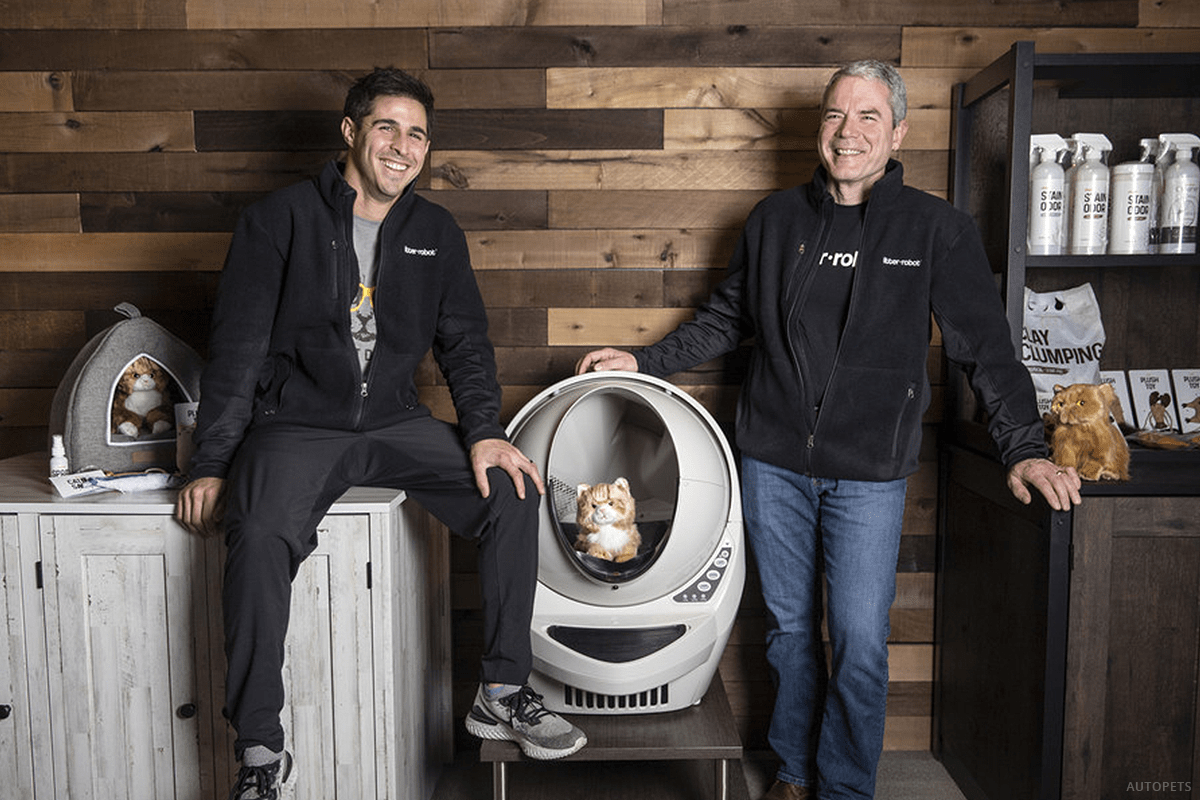

AutoPets LLC, the Auburn Hill, Mich.-based maker of the Litter Robot, self-cleaning litter box for cats (pictured above), said on Thursday, Dec. 5 it received a $31 million round of funding from an investor group led by Pondera Holdings LLC, the Chicago-based firm that’s also backed Dollar Shave Club, Dash Financial and Mrs. Call’s Candy Co…

Editor’s note: The original version of this article (Middle Market Digest: Nov. 22 and Dec. 5) was published earlier on The Deal’s premium subscription website. For access, log in to TheDeal.com or use the form below to request a free trial.

This Content is Only for The Deal Subscribers

If you’re already a subscriber, log in to view this article here.