Data centers are the heart of the artificial intelligence revolution and of many private equity investment strategies.

For instance, Blackstone Inc. (BX) has amassed a $55 billion data center portfolio and has a pipeline of additional investment that could top $70 billion.

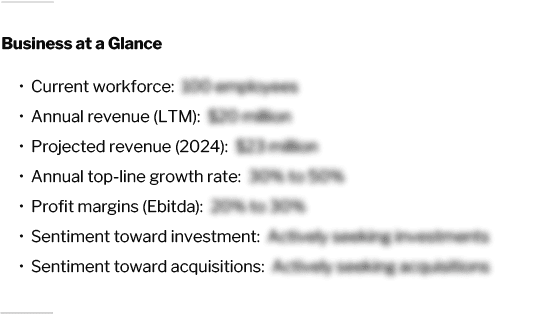

In the middle market, firms have to take a different approach.

“Data centers, even the equipment, are very capital intensive and require big dollars. For the lower middle market, that’s not really how we would play the theme,” said Matthew Clancy of Madison River Capital LLC.

Madison River, incidentally, was spun out of Jefferson River Capital LLC, the family office of former Blackstone Executive Vice Chairman Tony James, two years ago.

Earlier in July, the firm led a $190 million recapitalization of founder-owned datacenter electrical systems specialist JDC Power Systems Inc. and made a $70 million equity investment.

“JDC is how we would play that theme,” Clancy said. “It’s services based and not just plug-and-play maintenance services, but specifically dealing with mission critical power systems and how they respond in various scenarios.”

Madison River’s Course

Tony James asked David Wittels, with whom he had worked at Donaldson, Lufkin & Jenrette Inc. in the 1980s, to start Jefferson River Capital in 2016.

“We had a lot of success with our lower middle market control buyout strategy and decided to spin out in 2022 onto a standalone platform,” Madison River Capital’s Richard Dresdale said.

Founders are part of the playbook. With JDC, co-founders Joe Mastromonaco and Richard Corbin will continue to hold stakes.

Editor’s note: The original version of this article was published July 30, 2024, on The Deal’s premium subscription website. For access, log in to TheDeal.com or use the form below to request a free trial.

This Content is Only for The Deal Subscribers

If you’re already a subscriber, log in to view this article here.