Back to News

Mergers & Acquisitions, Private Equity, Activism and Restructuring Glossary

Published: June 22nd, 2020

#

13D Filing

- A form filed with the Securities and Exchange Commission by a person or group acquiring more than 5% of any voting shares in a company and that plans to lobby for change at the company. The Schedule 13D must be disclosed within 10 calendar days of acquiring the shares and include the investor’s intention, stake size and transactions over the preceding 60 days.

13F Filing

- A form filed quarterly with the SEC by institutional investors with more than $100 million in assets. The form is filed 45 days after the end of each quarter and must reveal the firm’s long positions.

13G Filing

- A form filed with the SEC when a person or group acquires more than 5% of any voting class of a company’s shares as a passive investment. A Schedule 13G may be converted into a 13D filing should the investor’s intentions change.

363 Sale

- The sale of corporate assets under Section 363 of the Bankruptcy Code. Under Section 363(f), a bankruptcy trustee or debtor-in-possession may sell the bankruptcy estate’s assets “free and clear of any interest in such property.”

A

Acquisition

- The outright purchase of a company by another company, investor, individual or group of such participants.

Activist Shareholder

- A shareholder — often a hedge fund — that seeks to drive change at corporations often through public contests, letters to directors and press releases. Tactics differ by firm, region and market depending on regulations.

Add-on

- An often small, strategic purchase of a company that is to be combined with another larger company with the agenda to acquire multiple companies.

Administration

- A corporate bankruptcy procedure common in the U.K., Australia, New Zealand and Germany, among various other countries. A company in administration is either about to become insolvent or already insolvent. Administrators, more often than not, receive appointment when the directors of the company pass a resolution, although they can also be appointed by a liquidator, secured creditor or via a court order. The job of a voluntary administrator is to inspect the company’s books, to communicate with creditors on these findings and to make a recommendation to these creditors as to what the company should do.

Asset

- A resource with economic value that a corporation owns or controls with the expectation that it will provide future benefit.

Asset Sale

- The sale of assets (as opposed to an operating business).

Assignment for the benefit of creditors

- An assignment for the benefit of creditors, or ABC, is a business liquidation procedure that may be available to insolvent companies under state law as an alternative to formal bankruptcy proceedings. In many instances, an ABC can be the most advantageous and graceful exit strategy. This is especially true where the goals are (1) to transfer the assets of the troubled business to an acquiring entity free of the unsecured debt incurred by the transferor and (2) to wind down the company in a manner designed to minimize negative publicity and potential liability for directors and management.

Auction

- A sale process that included marketing the company to multiple suitors.

B

Bankruptcy

- A federal court procedure that helps businesses get rid of their debts and repay their creditors.

Bankruptcy Buyout

- The sale of a bankrupt company, its assets or both.

BIA (Bankruptcy and Insolvency Act)

- A statute that regulates the law on bankruptcy and insolvency in Canada.

Board of Directors

- An appointed or elected panel that oversees the activities of a company and has a fiduciary duty to act in shareholders’ best interests.

BOE

- Barrel of oil equivalent.

Breakup Fee

- A fee associated with a merger or acquisition agreement to be paid by the target in the case it does not complete an announced deal. The fee is usually associated with a target that has accepted a higher bid from another party.

Bumpitrage Campaign

- An activist campaign with the goal of driving the price of an agreed to deal higher. Play on arbitrage campaigns used in Europe.

C

Carve-out

- In M&A, the partial divestiture of a business unit in which a parent company sells a minority interest of a subsidiary or unit to outside investors. In bankruptcy, the reservation of a portion of a pool of funds such as a loan or sale proceeds for a party other than the one that normally would receive them.

CCAA (Companies’ Creditors Arrangement Act)

- A Canadian statute that allows insolvent corporations owing their creditors in excess of $5 million to restructure their business and financial affairs.

Chapter

- The Bankruptcy Code is organized into chapters. Except for Chapter 12, the chapters of the present code are all odd-numbered and are enumerated with Arabic numerals. (Before the Bankruptcy Reform Act of 1978, the chapters were numbered with Roman numerals.) Chapters 1, 3, and 5 cover matters of general application. Chapters 7, 9, 11, 12, 13 and 15 concern, respectively, liquidation (business or nonbusiness); municipality bankruptcy; business reorganization; family farm debt adjustment; wage earner or personal (i.e. nonbusiness) reorganization; and multinational bankruptcy.

Chapter 7

- A liquidation proceeding in which the debtor’s nonexempt assets, if any, are sold by a Chapter 7 trustee and the proceeds distributed to creditors according to the priorities established in the Bankruptcy Code.

Chapter 9

- A bankruptcy proceeding that provides financially distressed municipalities with protection from creditors by creating a plan between the municipality and its creditors to resolve the outstanding debt.

Chapter 11

- A chapter used by businesses to reorganize their debts and continue operating.

Chapter 12

- A chapter used by family farmers and family fishermen to restructure their finances and avoid liquidation or foreclosure.

Chapter 15

- A chapter added to the Bankruptcy Code in 2005 to foster a cooperative environment in international insolvencies. Chapter 15’s primary goal is to promote cooperation between U.S. courts, appointed representatives and foreign courts.

Confirmation Hearing

- The hearing in a Chapter 11 case where a judge considers final approval of a reorganization or liquidation plan. A confirmed plan usually can be implemented shortly afterward, ending a bankruptcy case.

Consent Solicitation

- A request made by a shareholder or group seeking the agreement of shareholders to change the terms of a security agreement. Also used by companies to seek the agreement of security holders to modify terms and by an activist investor to nominate a dissident slate of directors in an expedited fashion, without a need to wait for a corporate annual meeting.

Corporate Governance

- The rules and practices determining how a company is run and controlled.

Credit Bid

- An offer for a bankrupt company’s assets in which one of the bidders is a creditor and part of the bid consideration is in the form of debt owed.

Creditor

- An institution that extends credit by giving another entity permission to borrow money intended to be repaid in the future. In bankruptcies, suppliers of services that have yet to be repaid also are creditors.

Cross-border

- Any deal where the target, seller or buyer are based in different countries.

D

Debtor

- A company that owes money.

DIP (Debtor in Possession)

- A corporation that has filed for Chapter 11 protection and remains in control of property that a creditor has a lien against, or retains the power to operate a business.

Disclosure Statement

- A document describing a reorganization or liquidation plan in Chapter 11 cases in more simple language. Disclosure statements are distributed to creditors for use in voting on plans.

Divestiture

- The sale of a specific asset, or set of assets, to either satisfy regulatory concerns or business concerns — for example, a pharmaceutical company selling its pet food unit to exit the sector.

Downstream

- Used to describe energy companies that turn raw products into refined products used by consumers or that deliver refined products to consumers.

E

Earnout

- A provision, typically associated with an acquisition, where the buyer agrees to make additional payments based on future performance metrics such as cash flow projections, revenue growth or sales targets. Also known in some cases as contingent value rights.

EBIT

- Earnings before interest and taxes.

EBITDA

- Earnings before interest, taxes, depreciation and amortization.

EBITDAR

- Earnings before interest, taxes, depreciation, amortization and rent.

Equity

- The value of the debtor’s interest in property that remains after the liens and other creditor’s interests are considered.

European Commission

- The executive branch of the European Union.

European Union

- A political and economic group of 28 countries and states, mainly in Europe. Member states include Austria, Belgium, Bulgaria, Croatia, Cyprus, the Czech Republic, Denmark, Estonia, Finland, France, Germany, Greece, Hungary, Ireland, Italy, Latvia, Lithuania, Luxembourg, Malta, the Netherlands, Poland, Portugal, Romania, Slovakia, Slovenia, Spain, Sweden and the United Kingdom.

F

Fixed Income

- Associated with securities, typically bonds or other debt securities, that bear interest at a fixed rate typically over a specified term.

G

Glass-Steagall Act

- A provision of former U.S. law that governed the roles and services of investment banks and other financial institutions involved in changes in corporate control and initial public offerings. Sponsored by Sen. Carter Glass, a former Treasury secretary, and Rep. Henry Steagall, chairman of the House Banking and Currency Committee, it prohibited commercial banks from participating in the investment banking business and vice versa. Enacted in 1933, it was repealed in 1999.

Greenfield (project)

- A nascent project or discipline where established practices, policies and industry restraints do not exist. Often refers to energy projects.

Go-shop

- A sale that includes a period that a seller/target can solicit competing bids.

I

Insolvency

- An inability to pay one’s debt.

Investment

- A purchase of part of a company. If the buyer has no interest in participating in the administration of the company, it is a passive investment; otherwise, it is an active investment.

Involuntary Bankruptcy Filing

- A bankruptcy in which creditors seek to push a company into court protection rather than a debtor taking action itself.

Item 4

- The section of a 13D filing that details the investor’s plan to engage with the company in which it has a stake purchased to lobby for changes.

J

Joint Venture

- A vehicle formed by two (or more) parties, often used strategically for M&A.

L

Lender

- A financial institution that makes funds available to another with the expectation that the funds will be repaid in addition to any interest, fees or both, either in increments or as a lump sum.

Leveraged Buyout (LBO)

- A transaction in which a company or asset (e.g., a real estate property) is purchased with a combination of equity and significant amounts of borrowed money, structured in such a way that the target or its assets are used as the collateral (or “leverage”) to secure and repay the borrowed money. [Buyer is a PE Firm, Target can be public or private company]

Liabilities

- A company’s financial debt or obligations that arise during the course of its business operations.

LIBOR (London Interbank Offered Rate):

- A floating interest rate participating banks offer to other banks for loans on the London market. Libor is set to be phased out in 2021 after a series of bank scandals.

Lockup Agreement

- An agreement by which owners, shareholders and/or management of a company agree not to sell shares in a particular holding for a certain period of time.

M

Majority Stake

- A larger than 50% holding in a company.

Management Buyout (MBO)

- A deal in which the target company’s management is a buyer.

Merger

- A deal in which two companies combine, often to form a third company.

Microcap

- Companies, often public, with market capitalizations or valuations below $300 million, according to the Securities and Exchange Commission.

Middle Market

- The middle market includes a range of deal values and company sizes, and its classification varies from firm to firm and organization to organization. Generally, the middle market is described as transactions between $300 million and $1 billion, though some firms define the middle market as much higher or lower. The Deal, for purposes of editorial coverage, recognizes the middle market as deals with a value below $500 million.

Midstream

- Used to describe energy companies that transport energy products from the point of production to storage facilities and store such products until they are ready to be refined, exported or both.

Minority Stake

- A less than 50% stake in a company. Investment firms sometimes sell majority control of a company but retain a minority stake.

N

Noncore Assets

- Property, business units or subsidiaries considered outside a given company’s main purview.

Noteholder

- A holder of notes issued by a company.

P

Pac-Man Defense

- Describes a scenario where a company resists a hostile takeover by launching a bid for its pursuer.

Platform Company

- A company designed to acquire and consolidate similar, smaller business. Often associated with a private equity-backed companies.

Portfolio Company

- A company that has been acquired or invested in by a venture capital or private equity firm.

Prearranged Bankruptcy

- A case where a debtor enters Chapter 11 with a reorganization or liquidation plan but has not negotiated with creditors.

Prenegotiated Bankruptcy

- A case where a debtor enters Chapter 11 after negotiating the terms of a restructuring with its major stakeholders.

Prepackaged Bankruptcy

- A case where a debtor enters Chapter 11 after sending out a reorganization plan to creditors for voting.

Price-Earnings Ratio

- The ratio of the price of a company’s stock to its earnings per share. Can be referred to as P/E ratio on second references.

Prime Rate

- The prime rate is the interest rate that commercial banks charge their most creditworthy customers. Generally, a bank’s best customers consist of large corporations. The prime interest rate, or prime lending rate, is largely determined by the federal funds rate, the overnight rate that banks use to lend to one another; the prime rate is also important for individual borrowers, as it directly affects the lending rates available for a mortgage, small-business loan or personal loan.

Private Acquisition

- A transaction in which target, seller and buyer are all privately held (noninvestment firms).

Private Equity

- Pools of capital raised from accredited or qualified investors by investment firms to invest in various asset classes including equity and debt as well as other alternatives. Typically, the resulting fund is managed by the firm, referred to as the general partner. It allocates the capital raised from those investors, who are limited partners.

Privatization

- The purchase of a public company, which on completion of the transaction will cease to sell securities to the public on a stock exchange.

Proxy Fight

- An investor may seek to install director candidates on a corporation’s board in an effort to drive some sort of operational, strategic or executive compensation changes at the target company. In a proxy fight, the fund’s nominees are pitted against incumbent management-backed directors in a contest that typically takes place at the corporation’s annual meeting.

Proxy Filing

- A filing by a company or an activist investor detailing their position on proposals that are up for a vote at a company’s annual meeting.

R

Recapitalization

- Also called a recap, a corporate reorganization involving substantial change in a company’s capital structure. Usually, a large part of equity is replaced with debt or vice versa, potentially resulting in a change of ownership. In more complicated transactions, mezzanine financing and other hybrid securities may be involved.

Receivership

- A type of corporate bankruptcy in which a receiver is appointed by a bankruptcy court or creditors to run the company.

Reorganization Plan

- A proposal of how to repay creditors under Chapter 11 of the U.S. Bankruptcy Code.

Restructuring

- A general term applied to any attempt to reorganize and satisfy debts, whether in or out of court.

Reverse Merger

- A purchase of a public company resulting in the buyer being absorbed into the target.

Rival Suitor

- A party with a competing offer in a deal.

Rollup

- An acquisition of a smaller company by a larger company. This transaction type is typically associated with private equity-backed platform companies. In Chapter 11 cases, rollup refers to payment of existing debt with new debt issued during the case.

Runoff

- An insolvent insurance company winding down operations is said to be in runoff. Outside the insurance industry, the term can apply to changes in a bank’s portfolio of loans.

S

Sarbanes-Oxley Act

- Passed in 2002, the law established auditing and financial regulations for public companies. Specifically, among other things, Sarbanes-Oxley requires officers of companies to be personally liable for the accuracy and level of disclosure in their financial statements.

Secondary Buyout (SBO)

- A private equity firm selling one of its portfolio companies to another private equity firm.

Section 304

- A defunct section of bankruptcy that dealt with multinational bankruptcies. Replaced by Chapter 15.

Share Buyback

- Repurchase of a company’s own shares either through open stock market purchases or a negotiated deal with a major shareholder.

Silicon Valley

- An area of California known for its technology innovation and companies such as Apple Inc., Intel Corp. and Google parent Alphabet Inc. The region includes the following cities: Campbell, Cupertino, Foster City, Fremont, Hillsborough, Los Altos, Los Gatos, Menlo Park, Milpitas, Mountain View, Palo Alto, Redwood City, Redwood Shores, San Carlos, San Jose, San Mateo, Santa Clara and Sunnyvale.

Spinoff

- The creation of an independent company through the sale or distribution of new shares of an existing business or division of a parent company. Also known as a demerger outside the U.S.

Staggered Board

- A board of directors on which every member is not up for election in the same year. This structure often lowers the risk of a corporate takeover by an activist hedge fund or unsolicited bidder seeking to install dissident director candidates.

Stalking Horse

- A stalking horse is the initially selected bidder ahead of a bankruptcy auction. It can also be a lowball or insincere offer to set up a competitive bidding process.

Standstill Agreement

- An agreement frequently employed between an activist and a company where the former agrees not to agitate at the latter for a set period of time, in exchange for concessions, often board seats.

Strategic Purchase

- A deal in which the buyer and target are in the same or complementary business segments. This is also referred to as “inorganic growth.” The buyer is looking to build its market share, product line or both, or even enter new markets through the purchase of an already established company with the desired position.

T

Tender Offer

- A public offer or invitation by a prospective acquirer to all stockholders of a publicly traded corporation to offer their stock for sale at a specified price during a specified time, subject to the tendering of a minimum and maximum number of shares. Companies also use tender offers with debtholders when exchanging debt out of court.

U

Update to Terms

- Deals with changes to the value offered or how deal consideration is to be paid out.

Upstream

- Used to describe energy companies that extract raw products such as crude oil and natural gas from their source using techniques such as drilling and hydraulic fracturing.

V

Venture Capital

- Pools of capital raised to fund early-stage companies.

W

White Knight

- A person or company making an acceptable counteroffer for a company facing a hostile takeover bid.

White Square

- An investor who buys stakes in a company in the best interest of that company, usually with the intent to prevent a hostile takeover of that company. It is also often used by corporations to defend themselves against activist hedge funds seeking to install dissident director candidates.

More From Uncategorized

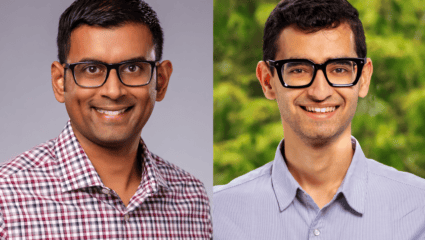

Popping the AI Hyperbole Bubble

By David Marcus

|

Published: October 1st, 2024

In their new book 'AI Snake Oil,' Princeton professor Arvind Narayanan and former Facebook engineer Sayash Kapoor suggest that the use of AI in the workplace will be more evolutionary than revolutionary.

Private Cos.

Environmental Consultancy EI Group Grows Where Clients Go

By Huzair Latif

|

Published: February 28th, 2024

M&A

Chesapeake Buys Chief Oil, Sells Wyoming

By Tom Terrarosa

|

Published: February 1st, 2022