It is no surprise that activists and the companies they target are shifting gears amid the coronavirus pandemic. In particular, insurgent investors have increased scrutiny on executive pay, operational performance and board alignment at the world’s top companies rather than agitating for M&A or buybacks. Many activist campaigns in 2020 want chief executives out, and they are often ready with candidates to fill the position. But companies aren’t standing by as their valuations dip and they become susceptible to activists or hostile bids. To defend themselves, corporations have installed poison pills of all shapes and sizes and sold large chunks of shares or debt to private investors to secure their positions and the viability of their companies. How effective has the 2020 wave of shareholder rights plans been in defending companies from activists? What other strategies are companies employing to defend themselves amid the pandemic and how are activists approaching campaigns during one of the biggest economic disruptions of the last century?

Panel:

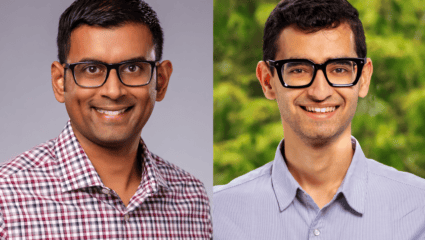

- Christopher Kiper (Co-Founder & Managing Director, Legion Partners)

- Ken Bertsch (Executive Director, Council of Institutional Investors)

- Ben Rosenzweig (Partner, Privet Fund)

- Martin L. Seidel (Partner, Willkie Farr & Gallagher LLP)

- Ronald Orol (Senior Editor, The Deal)