The market for PIPE (Private Investment in Public Equity) transactions is growing. This corner of Wall Street — once considered a dark alley for dealmakers — is gaining prominence as dealmakers seek additional paths to liquidity, especially in the wake of the Covid-19 pandemic. PIPEs, privately negotiated transactions between a public company and an investor, can include ordinary shares, preferred shares, convertible debt or warrants at various rates, and have been around for years. They enable companies to raise cash quickly and give investors the ability to acquire stakes in listed companies, often at a discount, without many of the hurdles that go along with a typical acquisition or merger.

But as Covid-19 has strained balance sheets and left some investors looking at tough paths to exits, the world’s top companies are using these financial instruments now more than ever. We’ve also seen some PE firms take stakes in large public companies through PIPEs. Will this trend continue as the coronavirus increases pressure on balance sheets and forces companies to seek alternative sources of capital and owners, other sources of liquidity? What challenges do these transactions pose, especially at a time of depressed valuations? What nuances proliferate these transactions that differ from your typical M&A transaction?

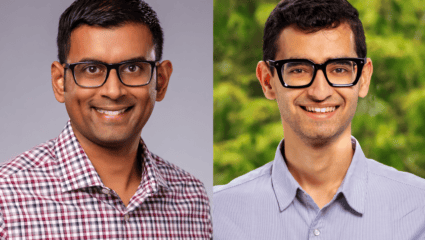

Panel:

- Dan McClory (Managing Director, Head of Equity Capital Markets and Head of China, Boustead Securities, LLC)

- Jonathan Bates (Chief Investment Officer, Innovative Digital Investors)

- Ross Leff (Partner, Capital Markets, Kirkland & Ellis)

- MODERATOR: Steve Gelsi (Senior Reporter, The Deal)